Welcome to Navium Marine. We are a marine focused specialty MGA.

We strive to create a digitally enhanced business blending underwriting, claims leadership and competence with modern day solutions.

Our team are all long-standing insurance market professionals with a strong desire to leave a legacy of technical performance and discipline and not just ride underwriting cycles. We have a track record of delivering profitable results and we are committed to delivering value to our capacity and to our clients.

Navium Marine Limited was established in May 2021 with a focus on quality marine insurance. Our team has a reputation for approachability and flexibility in developing new structures for both existing and emerging risks.

Clive Washbourn CEO, CUO & Director

Clive is a market-leading figure with executive experience spanning 36 years in the Marine and Specialty markets. He has a reputation for building balanced portfolios and delivering upper-quartile results in the Lloyd’s Market, and has a track record of producing significant underwriting profits for the businesses he has worked for across market cycles.

Prior to starting Navium , Clive was Head of Marine at Beazley, where he fostered deep relationships with brokerages and global marine insurance buyers, and built and developed high performing teams for succession.

Oliver Clark Deputy CUO & Senior Underwriter

Ollie has previously worked as a Marine Underwriter at Atrium, AXA XL and MS Amlin, specialising in Marine and Energy Liabilities and Ports and Terminals. Ollie graduated from the University of Sheffield in 2010 and worked at Rothschild before joining the insurance industry 11 years ago. He recently completed an MBA at Cranfield University’s School of Management.

Henry Maughan Head of Cargo & Specie

Henry has over 16 years’ experience in the London Market. His most recent role was leading the Cargo team at Antares where they delivered and exceeded their budgeted income targets and exceeded their loss ratio targets. Notably, Henry drove the team through the Lloyd’s decile 10 process, and was one of the few cargo portfolios to grow the income in 2018-2019. Henry was a member of the Joint Cargo Committee for 2020 and 2021.

Alice Edwards Chief of Staff

Alice has over 5 years’ experience in the London Market and joined Navium in June 2022. Previously she had been at Hiscox where she worked primarily with the Marine and Energy Leadership Team. After graduating in Law from University of Exeter she worked within the tech industry before joining the Insurance Market.

Alex Hill Hull & War Assistant Underwriter

Alex joined Navium in August 2022. Prior to which he worked at Willis Towers Watson for 3 years, during which time he worked in various area, including Hull and Machinery on both placement and claims, whilst also assisting the Bloodstock and Livestock claims team. Alex has completed his Diploma in the CII, holds a Graduate Diploma in Law from the University of Law in 2019 and achieved a BA in History from University of Exeter in 2017.

Amy Slade Underwriting Assistant

Amy Joined Navium in October 2022. She has many years’ experience within the Lloyds Insurance market supporting underwriters across a broad range of classes of business. Amy’s insurance career began at Xchanging before working at Brit Insurance and the last 11 years at Antares Syndicate.

Beth Wells Underwriting Assistant

Beth joined Navium in May 2023 having graduated with a BSs/degree in Physical Geography from the University of Reading. She went on to complete a Masters in Environmental Management from the University of London, Birkbeck in September 2023.

Cameron Hagley Claims Assistant

Cameron joined Navium in January 2023 as her first role within the London Market. She is developing her understanding of Marine Claims and is specialising within H&M and Marine Liability.

Constantine Hadjipateras Claims Manager

Constantine joined Navium in June 2023. Prior to joining he was a Claims Manager at Seascope Insurance Brokers for 9 years, specialising in Hull & Machinery and Yacht claims. He graduated in 2010 from Bayes Business School with an MSc in Shipping, Trade and Finance.

Danielle Basstoe Cargo & Specie Underwriter

Danielle joined Navium in June 2021 after 21 months as a Cargo Underwriting Assistant at Antares. Danielle completed her ACII qualification to become an Associate Member of the Chartered Insurance Institute in January 2022.

Eliza Kearns Claims Assistant

Eliza joined Navium in September 2023. Prior to this she completed a BA in French at the University of Bristol in June 2023.

Emma Roadnight COO

Emma joined Navium in November 2021 and has 13 years’ experience in the London Market. She first started out as a CAT Risk Analyst at Canopius and since then, she has worked at Travelers, MS Amlin and Antares, underwriting on the Cargo and Specie accounts. Emma holds a MSc in Business Analysis and Finance and a BSc in Economics.

Gemma Swan Underwriting Assistant

Gemma joined Navium in February 2023. She graduated from UCL in 2022 with a degree in History and French and before joining Navium was working in the FinTech Industry.

Lewis Ross Cargo & Specie Assistant Underwriter

Lewis joined Navium in February 2022 as his first role within the London Market. He has developed a strong understanding of Cargo and Cargo War.

Madison Wallis Senior Receptionist

Madison joined Navium in April 2023, previously working at Rathbones as a Reception Administrator. She graduated from the University of Chichester in 2017 with a BA Hons in Musical Theatre.

Michael Prendeville Cargo & Specie Underwriter

Michael joined Navium in March 2023 from WTW, where he was an Associate Director handling a global book of large and complex business. After graduating from the University of Nottingham in Economics, Michael joined the industry on the WTW graduate scheme, and became an Associate Member of the Chartered Institute of Insurance in 2018.

Millie Perrin Hull & War Underwriter

Millie joined Navium in November 2021 from the Lloyd’s of London Insurance Graduate Scheme. She undertook placements in the Lloyd’s Corporation, Canopius, and Marsh Marine Teams and completed her ACII. Millie graduated from the University of Cambridge with a BA in Anglo-Saxon, Norse and Celtic History and an MA from Newcastle University in Early Medieval Archaeology.

Noris Kanaharajah Underwriting Assistant

Noris joined Navium in August 2023 after 2 years as software developer for Worldline. He graduated from University of Portsmouth in 2021 with a Masters in Mechanical Engineering.

Ophelia O’Brien Underwriting Assistant

Ophelia joined Navium in May 2023 after graduating from Sheffield Hallam University in 2022.

Rosie Gillett Underwriting Assistant

Rosie joined Navium in July 2023 after graduating from the University of Southampton with a BSc in Environmental Science.

Sally Newing Claims Manager

Sally joined Navium in February 2024. Prior to joining she worked for Marine TPAs for 12 years, specialising in Cargo claims and also involved in GA and salvage matters. Sally began her London Market career in 1993 handling North American non-marine APH and LMX legacy claims.

Simon Fraser Underwriting Assistant

Simon joined Navium in June 2023 as a Hull and War Underwriting Assistant. Prior to this he completed the apprenticeship scheme at Lloyd’s of London.

Simone Holliday Senior Claims Manager

Simone has been working in the Marine insurance class for over 25 years. She joined Navium in November 2022 having previously handled yacht business as a claims and placing broker in the London market and has worked on Brown Water P&I, Hull claims, Blue Water Hull, SRL, Builders Risk, Comprehensive Marine General Liability, Ports & Terminals, Maritime Employers Liabilities, Cargo, War, LOH, Maritime Employers Liabilities, Energy Onshore/Offshore Physical Damage and Associated Liabilities.

Navium offers insurance across the full range of Marine classes. Our experience allows us to understand the keys risks faced by our clients whilst also looking to pioneer new approaches to risk selection and loss management.

Ship Building

Ship Owning

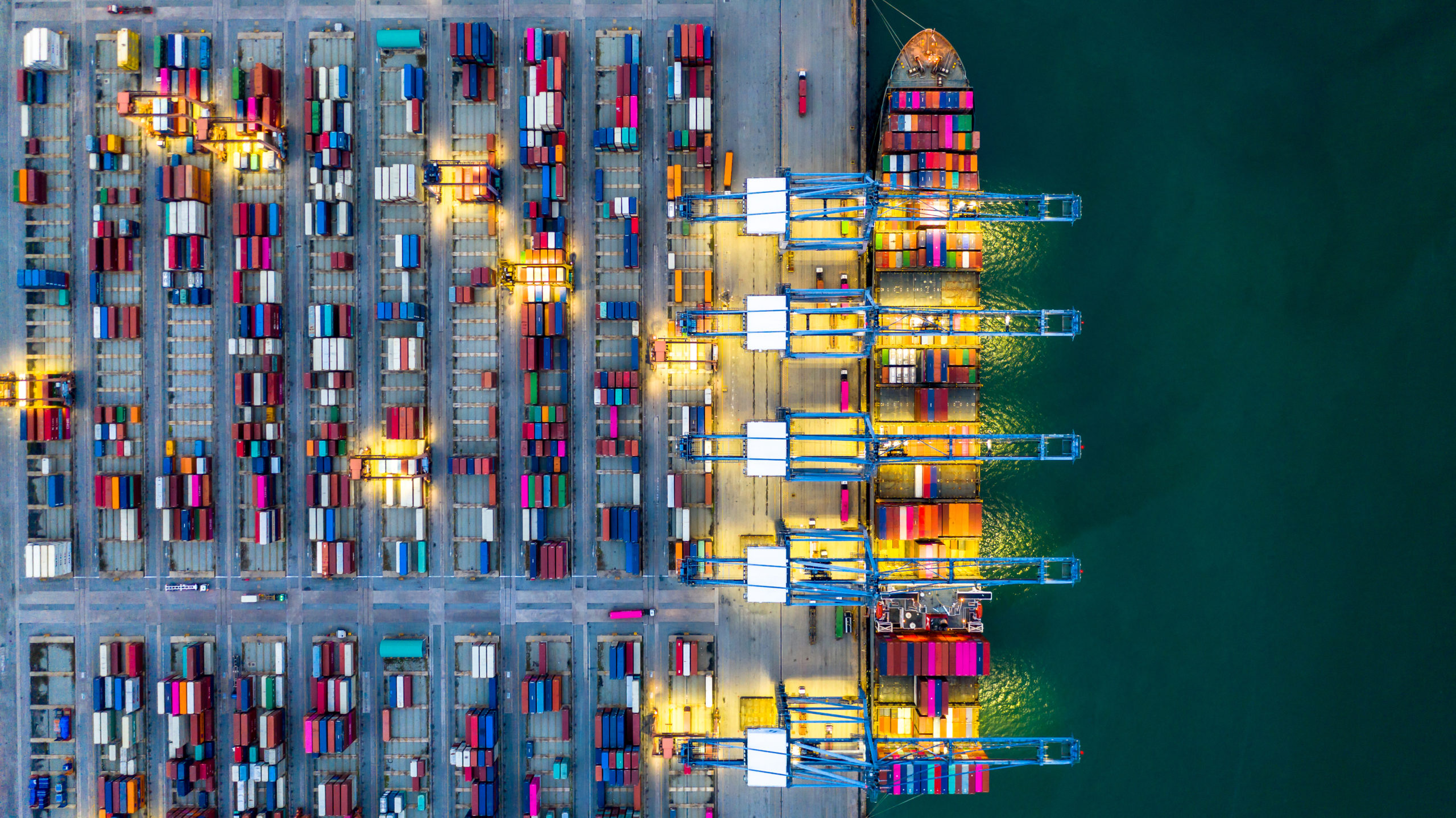

International Movement of Goods

Marine Liability

War/Kidnap and Ransom

Ports and Terminals

Global Yacht Cover is an underwriting facility offering yacht insurance with 100% Great Lakes Insurance SE security.

We insure all types of sailing yachts and motorboats globally, valued up to £10,000,000. Whether you are day sailing in local waters or setting off on an adventure of a lifetime around the world – Global Yacht Cover is the insurer for you. We specialise in short-handed, long distance voyages and if you have sufficient experience, we will consider longer single-handed passages.

Our ability to be flexible is one of our many assets and we provide comprehensive cover that will suit your individual sailing requirements. Our senior underwriter has worked in the insurance industry for over 35 years of which 29 have been spent underwriting yachts. He is also an accomplished yachtsman with 50 years of sailing experience, so understands that each sailor’s needs are individual.

We work together with you to ensure your “pride and joy” is suitably covered.

By SuperyachtNews 10 Aug 2018

Lloyd's superyacht insurance shakeup underway

Reports suggest between five and seven lloyd's syndicates have already dropped out of the yacht insurance market. further consolidation expected….

Earlier this year, Lloyd’s of London, the specialist insurance market, issued a warning to a number of its marine syndicates, including those that underwrite superyacht businesses. The warning gave loss-making marine syndicates three months to create viable business plans or be dropped – the deadline for the presentation of said remediation plans being Friday 3 August.

On 2 August, TradeWinds News reported that Brit Global Speciality, Lloyd’s syndicate 2987, ended its yacht insurance business lines. Since Brit’s exit, various reports have suggested that a further five to seven syndicates have pulled out of the yachting market. The shakeup of the Lloyd’s market follows a sustained period of falling premiums and unsustainable loss ratios. Yachts are widely considered to be the greatest loss maker within the Lloyd’s marine portfolio.

“I’ve been talking for a long time now about the sustainability of the insurance and what I mean by sustainability is this: the insurance market relies on simple principles, you create a pool of funds so that, when you claim, money comes out of that pool,” starts Simon Ballard, managing director of CRS Yachts. “Unfortunately, over the last five years in particular, the pool has not been big enough. Underwriters haven’t been charging enough money to cover the losses that have occurred. This is for a number of reasons, but over capacity and competition are chief among them.”

According to a number of sources, the Lloyd’s superyacht insurance market has been running on an unsustainable loss ratio

According to a number of sources, the Lloyd’s superyacht insurance market has been running on an unsustainable loss ratio. For a number of years, the Lloyd’s market operated at about 120 per cent loss ratio. In 2015 the Lloyd’s market collected around £150million of premium and operated at a loss ratio of 140 per cent, meaning that it paid out around £210million of claims. By all accounts, 2015 was a relatively uneventful year compared with those that followed.

Considering the losses that have occurred since, including two high-profile 100m-plus claims and the severe damage caused by the hurricanes that decimated the Caribbean and Florida in 2017, one can appreciate that the loss ratios since 2015 have continued to significantly worsen. TradeWinds News reports that a senior Lloyd’s broker has suggested that Lloyd’s is prepared to reject business plans and drop loss-making enterprises.

“In the last 10-15 years, there has been an oversupply of capacity that has softened the rates and create what, on the surface, appears to be healthy competition. But, ultimately it has driven rates to an all-time low. It got to the point where the insurance community unanimously agreed that there needed to be a market correction (rate increase), but no one seemingly acted on it,” comments Mike Taylor-West, director of global market at La Playa.

As a result of the severely unsustainable market softening, a number of syndicates, it would seem, have decided to withdraw from the market even before Lloyd’s has begun to decline business plans. It is expected that in the days and weeks to come that an even greater number of syndicates will drop out of the market.

As a result of the severely unsustainable market softening, a number of syndicates, it would seem, have decided to withdraw from the market

According to the TradeWinds report, Brit’s marine insurance business accounts for 10 per cent of its total business. Of that business, the yacht business lines were an even smaller proportion, with some estimates suggesting it accounted for significantly less that one per cent of the total business. As a result, businesses such as Brit are viewing the superyacht market, a loss making and relatively insignificant contributor to the larger group, as being surplus to requirements and have, therefore, cut their losses by removing themselves from the market place.

“People have been talking about rate rises but I don’t think that they have come fast enough because there is still over capacity in the market place,” continues Ballard. “I personally don’t think that just increasing the premium pot is going to be enough. Businesses are really going to have to look at how policies are underwritten and consider the whole mechanism in order for the system to become fairer. This process will happen, but it will happen slowly.

“If you consider that Lloyd’s is a superyacht market leader, we will see other businesses following suit because this is not just a Lloyd’s issue, we see overseas securities offering cheap and more unsustainable rates,” Ballard says. “This is crunch time, it is in everybody’s interest to create a sustainable market because if it isn’t, the clients suffer as there may not be insurers willing to underwrite this class.

It has been suggested that capacity in the sub-£5million category is likely to be affected the quickest, with the sub-£10million category also likely to be strong effected. “Sub-£10million is going to be more difficult, but all lines are going to be affected,” continues Ballard. “We are probably seeing the biggest change we are ever going to see in this business.”

“The strange side of this is that consumers would generally expect brokers to champion cheaper rates,” continues Taylor-West. “And yes, in a sustainable marketplace this would be the case, but ultimately that is not where we are and some of the suicidal rates that are currently available put the clients at risk. The current climate requires responsible broking. However, like the market itself, there is also an over-capacity of brokers and market players that has contributed to the pricing race to the bottom. The problem with a cheap marketplace is that it puts pressure on the claim and it leads the providers of the capacity to adopt positions that seek to find ways to narrow or avoid claims rather than paying them.”

In the coming days and weeks, it is expected that the market will experience further consolidation. It has also been suggested that, in order to foster a more sustainable marketplace, premiums are likely to increase.

Profile links

CRS Yachts Ltd

La Playa: Insurance with Intelligence

Join the discussion

To post comments please Sign in or Register

When commenting please follow our house rules

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here .

Related news

Transparency in the UHNW world

Clive Jackson, founder of Victor, explores why transparency is fundamental for client satisfaction

6 years ago

Sign up to the SuperyachtNews Bulletin

Receive unrivalled market intelligence, weekly headlines and the most relevant and insightful journalism directly to your inbox.

Sign up to the SuperyachtNews Bulletin

The superyachtnews app.

Follow us on

Media Pack Request

Please select exactly what you would like to receive from us by ticking the boxes below:

SuperyachtNews.com

Register to comment

- Seascope Europe

SEASCOPE HELLAS

- London Team

- Europe Team

- HELLAS TEAM

FIRST CLASS SERVICE

For first class clients.

Seascope Insurance Services is an independent insurance broker. We provide international marine insurance and reinsurance, operating in Lloyd’s of London and international markets. Our experienced specialist teams provide in-depth knowledge and quality services across all marine disciplines.

EMERGENCY CLAIMS HERE:

Providing our clients guidance and support in claims handling matters. Our dedicated experienced team, brings varied industry backgrounds and expertise to provide efficient tailored solutions to claims handling.

Emergency Contact

+44 7341 478 302

+44 7341 478 303

OUR SERVICES

Seascope provides extensive marine insurance knowledge and quality tailored services.

Hull & Machinery

Protection & indemnity, special risks, reinsurance, global network.

Our Global Network provides regional knowledge with a global perspective.

seascope europe

Seascope Europe S.M.P.C. is an associate company of Seascope Holdings ltd. Serving shipping clients in the European Economic Area. Seascope Europe’s U.K. branch is located in London.

VScope Risk Management Ltd is an associate company of Seascope Insurance Services, providing ship owners with advice and guidance on marine insurance and comprehensive cover.

Tigermar is an associate company of Seascope Insurance Services, offering direct insurance and reinsurance broking, headquartered in Singapore.

Seascope Hellas S.A. is a fellow subsidiary company of Seascope Insurance Services. Seascope Hellas serves shipping clients located in Greece and the Middle-East from the Piraeus office.

SEASCOPE HONG KONG

Seascope Insurance Services Hong Kong (SISHK) is a sister company of Seascope Insurance Services. SISHK’s mission is to capture the Asian insurance markets with knowledge and experience.

MEET THE TEAM

The Seascope team provides extensive marine insurance knowledge and quality tailored services.

You are using an outdated browser. Please upgrade your browser to improve your experience.

An Atlass Insurance / Risk Strategies Company

The solution for year round windstorm navigation insurance requirements, boat owners +1 800.330.3370, insurance agents +1 866.471.9722, seawave home, boat owners, insurance agents, yacht & boat owners seawave insurance, the seawave yacht & boat insurance plan created exclusively by the atlass insurance group provides insurance coverage underwritten by lloyds of london..

The Seawave program is designed for the recreational boater and provides boat insurance coverage directly to yacht owners and insurance agents & brokers. This insurance program is designed for select North & Central American cruising areas including, Mexico, the Caribbean & the Bahamas islands. Atlass Insurance Group has tailored this coverage for power boat and sailor who may plan to cruise exclusively in select areas.

Knowledgeable and Experienced Insurance Specialists. Contact Us Today! Yacht & Boat Owners +1 800.330.3370 and Yacht Insurance Agents +1 866.471.9722

- Show more sharing options

- Copy Link URL Copied!

Global 2023 marine premiums hit $38.9bn and London increases hull share: Iumi

There has been an exodus of hull premium from the london market to nordic carriers since 2014..

Global marine insurance premiums grew by 5.9% to $38.9bn in 2023, driven by a combination of increased insurable volumes and improving rate, according to the International Union of Marine Insurance (Iumi).

Login to continue

Please enter your email address below.

Opening your single sign-on provider...

Questions about your access? Refer to our FAQs for answers or appropriate contacts

Fuel a smarter strategy with our actionable market intelligence

- Gain a competitive edge and accelerate decision-making

- Be empowered by insights that transform confusion to clarity

- Uncover growth opportunities and prepare for potential threats

As a premium subscriber, you can gift this article for free

You have reached the limit for gifting for this month

There was an error processing the request. Please try again later.

The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Conservation and Philanthropy

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- BOATPro Home

- Superyacht Insight

- Global Order Book

- Premium Content

- Product Features

- Testimonials

- Pricing Plan

- Tenders & Equipment

Superyacht insurance: How to choose the best policy for your yacht

Related articles.

Picking insurance coverage for your superyacht can be fraught with difficulty. BOAT reveals what owners really need to know when it comes to yacht insurance and how to keep the process as pain-free as possible if the worst happens.

When it comes to superyacht insurance, shopping around for the best deal may not be the smartest tactic. “Many of the insurance policies and contracts out there are quite similar, but, as with everything, the devil’s in the detail. Sometimes what may appear to be a really good option might contain some restrictions or exclusions in cover that might catch the unwary person out,” says Mike Wimbridge, managing director of Pantaenius UK.

Indeed, insuring superyachts worth tens to hundreds of millions of pounds, plying waters subject to windstorms and even perhaps political upheaval, is complicated. There are a lot of considerations at play and in the end what you see on your policy is what you get. “Marine insurance is not specifically regulated, meaning policy forms don’t have to be approved by any regulators in any country or state like other types of consumer insurance do. So whatever you get on your policy contract is what you get today for insurance, and it could be different for everyone,” says Nancy Poppe, North American Yacht Practice Leader at Willis Marine Superyachts.

In general, there are two types of insurance a yacht needs: Hull and Protection & Indemnity (P&I). Hull covers physical damage to the vessel and its appurtenances, while P&I is marine liability insurance for third-party liability, explains Poppe. The larger the yacht and/or the more complex its cruising programme, the more likely this coverage will be split with P&I provided by a P&I Club. “They offer a single shot $500 million P&I limit, and they can very easily offer all of the certificates,” says Spencer Lloyd, president of AssuredPartners’ yacht speciality team. “For instance, there’s something now called the Nairobi Wreck Removal endorsement and some of the companies that do both Hull and P&I do not have the ability to issue these certificates for a yacht travelling in foreign waters.”

The marine insurance market currently is a bit turbulent, which means not every yacht is insurable. A few years ago a large number of underwriters – overwhelmed by hurricanes and fires – pulled out of the marine market, creating a hard market where demand exceeded supply. It’s since stabilised to some extent, helped by the fact that 2021 churned up no serious windstorms, but underwriters today can still afford to be picky.

Wimbridge likens the last few years to “panning for gold”, as the market was shaken up to see where things lie. “The London market, the traditional home of the superyacht market, is not comfortable below USD10 million. So the more domestic markets are picking those risks up, whether that be US or Europe or Australia. I think above 10 million, it’d be fair to say the London market has been choosy over recent years,” says Wimbridge. But he is seeing more competition creeping in for what insurers would class the more desirable risks in the megayacht area, so that’s leading to a steadying of the market. The under-$5 million market, though, is more volatile, subject to holes when a single underwriter pulls out.

Factors that affect a yacht’s insurability include its age (even if it’s refit), whether it will be based in a windstorm-prone area, and the owner’s experience, explains Poppe. “For boats that, say, want to summer in Florida and winter in the Caribbean, there are very limited choices particularly in the smaller end of things. And first-time owners jumping into large-sized vessels with no prior ownership experience and not hiring a full time professional manager – there's limited, if any, options for coverage there,” she says. With this in mind, she advises any prospective owner to secure an offer of insurance before they accept an offer to buy a yacht.

Once the insurance is in place, the communication doesn’t stop. There are a few situations where it’s common that the underwriter requires advance notice or coverage can be excluded. One of these is yard work.

“A lot of yacht policies will exclude welding and hot work until you notify them first and beforehand,” says Lloyd, explaining that the underwriter will typically want to see a copy of the yard’s insurance certificate, any independent contractor’s liability, a drawing of what welding is going to take place and a gas-free certificate if the tanks have to be cleared of flammable liquids. The difficulty he has seen lately is when the shipyard wants a complete waiver of liability, a situation he deems unfair. “A lot of times the company insuring the yacht will come back and say, ‘Hey, we want a $10,000 to $15,000 additional premium for the exposure of what you're having done’.”

How underwriters consider named windstorms also differs, with at least one excluding all coverage for yachts under 500 gross tonnes. “In the old days, the bigger boats didn't necessarily need a hurricane plan. But in this day and age, most underwriters are asking to see the hurricane plan for all sized yachts,” says Poppe.

“If you're going to be in the shipyard, having work done during hurricane season, you need to give your underwriter a lot of advance notice,” she continues. “If you're not going to be able to move the vessel to sea in the event of a storm coming, you are probably going to face either no coverage for windstorm or a quite high deductible for windstorm.”

Another point that could be lost in the fine print is itinerary exclusions. “For instance, there are parts of the world that are deemed to be political hotspots, so they tend to be excluded from the war cover,” says Wimbridge.

Insurance companies also want to be involved in choosing the captain. “They have gotten much more strict about captain resumes,” says Lloyd. “Rule of thumb was the captain must have a minimum of two years’ experience on similar-size boats to the one that they are applying for. And some have raised it to three years. We are in a constant battle because with so many boats being sold, there’s not enough qualified people to fill the positions. And how does the mate, who is good and capable but doesn’t have the resume, take the next step?”

With all of these considerations, it’s crucial that the owner – whether they are dealing directly with an underwriting agent like Pantaenius UK or working with a broker like Poppe or Lloyd – is being advised by someone they trust and someone experienced in insuring yachts of a similar type and cruising programme.

In the end, insurance is a relationship business, Wimbridge points out. “The selection of the insurance partner and, if appropriate, the insurance broker, I think is paramount because those parties are experts in this process and often the clients aren’t. And in many cases, the ultimate client isn’t the one doing the negotiation. Depending on how large the boat is, there can be several people in that chain involved in the pre-discussions, offering their own thoughts and advice, which might not necessarily be the most helpful. The advice in all aspects of this is to choose the right partner, people that will give you proper advice.”

Sign up to BOAT Briefing email

Latest news, brokerage headlines and yacht exclusives, every weekday

By signing up for BOAT newsletters, you agree to our Terms of Use and our Privacy Policy .

More stories

Most popular, from our partners, sponsored listings.

Lloyd's List is part of Maritime Intelligence

- Lloyd's List Intelligence

This site is operated by a business or businesses owned by Maritime Insights & Intelligence Limited, registered in England and Wales with company number 13831625 and address c/o Hackwood Secretaries Limited, One Silk Street, London EC2Y 8HQ, United Kingdom. Lloyd’s List Intelligence is a trading name of Maritime Insights & Intelligence Limited. Lloyd’s is the registered trademark of the Society Incorporated by the Lloyd’s Act 1871 by the name of Lloyd’s.

This copy is for your personal, non-commercial use. For high-quality copies or electronic reprints for distribution to colleagues or customers, please call UK support at +44 (0)20 3377 3996 / APAC support at +65 6508 2430

- Red Sea Risk

- Ukraine Crisis

- Decarbonisation

- Digitalisation

- Sustainability

- Tankers & Gas

- Ports & Logistics

- Technology & Innovation

- Crew Welfare

- Law & Regulation

- Piracy & Security

- Daily Briefing

- Special Reports

- The Future of Shipping

- Podcasts & Video

- The Week in Charts

- The Week in Newbuildings

- Latest Market Outlook

- One Hundred Container Ports 2024

- One Hundred People 2023

- One Hundred People 2023 - Top 10s

- Archive: One Hundred People

- Archive: One Hundred Ports

- Archive: Lloyd's List Magazine

- Archive: Shipping’s Global Boardroom

- Markets Data

- Containers Data Hub

- Directories

- Marketing Solutions

- Editorial Calendar

- Advertising & Sponsorship

- Sponsored Content

- Meet the Team

- Editorial Board

Top 10 in marine insurance 2022

Most classes are hardening after years — and sometimes decades — in the doldrums; most underwriters are even making money again.

- 28 Nov 2022

- Lloyd’s List

Marine insurance has been well to the fore in 2022, providing war risk cover for both ships and cargo carrying vitally needed grain from Ukraine to markets in the developing world, as well as day-in, day-out P&I and H&M policies

01 / Chris McGill, Ascot

Chris McGill is head of marine cargo at Ascot Group, where he has worked since 2007, and is active underwriter for syndicate 1796.

He was in the headlines in 2022 after Ascot, together with leading broker Marsh, launched a $50m marine cargo and war risk facility designed to cover the continued export of grain from Ukraine despite the Russian invasion of that country.

The initiative was a vital lifeline for millions of people in North Africa and the Middle East who depend on Ukrainian grain as a staple foodstuff.

Mr McGill’s LinkedIn profile offers an obvious clue to his interests outside work, highlighting his level three advanced certificate in wine tasting from the Wine & Spirit Education Trust. Grade: distinction.

02 / Frédéric Denèfle, IUMI/Garex

The International Union of Marine Insurance elected a new president at its conference in Chicago in September 2022, with the job going to French war risk underwriter Frédéric Denèfle.

Mr Denèfle started his career on the legal side of claims handling, first with Paris-based Reunion Européenne — now subsumed into AXA — and then with Cesam, an organisation that handles big claims for the French market.

He joined AGF MAT/Allianz Group in 1998 and worked there until 2012.

In 2013, Mr Denèfle started a new role at Garex to become managing director of underwriting of marine war insurance in Paris.

The company acts as a war risk pooling arrangement for eight European insurers and is certainly the dominant player in France, with $200m capacity for hull and $50m for cargo. It also partners with other war risk reinsurers.

03 / Song Chunfeng, China Shipowners Mutual Assurance Association

Song Chunfeng wears many hats in addition to being the managing director of China Shipowners Manual Assurance Association, known as China P&I Club.

These include being a member of the Shipping Economics Review Committee of Asian Shipowners’ Association and a board director of Steamship Mutual.

Under his leadership, the club — a dominant player in China’s P&I insurance market and a major domestic hull insurance provider — has won its first international credit ratings in 2022 from AM Best.

The agency has assigned a financial strength rating of A- and a long-term issuer credit rating of ‘a-’ to reflect the Chinese association’s strong balance sheet and adequate operating performance.

It said China P&I’s risk-adjusted capitalisation was assessed as being at the strongest level, as of year-end 2021, and expected to remain so over the short to middle term, underpinned by continued growth through full earnings retention and a low underwriting leverage.

While its current portfolio focuses heavily on Chinese-owned vessels in domestic markets, the club is said to be looking at opportunities in overseas markets such as Southeast Asia to diversify its member base.

Mr Song holds a doctoral degree in Chinese civil and commercial laws from Peking University and a practising certificate in China.

04 / Dorothea Ioannou, The American Club

It has taken until 2022 for an International Group P&I club to appoint a woman chief executive , with Dorothea Ioannou taking over at Shipowners’ Claims Bureau, manager of The American Club.

Ms Ioannou is a lawyer by training, practising in Greece and New York. She is also a previous head of the claims and legal department at Allied Insurance Brokers.

She has taken on a tough job. The American Club is one of the smallest in the International Group and, in 2021, it was forced to levy supplementary calls on its members.

In an interview with Lloyd’s List to mark her promotion, Ms Ioannou promised to adopt a no-nonsense approach.

“I do believe in being very straightforward and transparent. I was always like that,” she said.

“I am not saying you should come out with all guns blazing; but I think it’s important to be ready to resolve issues and you need to be direct.”

05 / Louise Nevill, Marsh JLT Specialty

Career marine underwriter Louise Nevill has been chief executive, marine and cargo at Marsh JLT Specialty UK — one of the world’s largest marine brokers — since the start of 2020.

Her wide-ranging CV saw her start as an assistant marine underwriter at Markel after graduation in 1996, since when she has also worked as head of marine at Talbot, director underwriting at W/R/B and, latterly, vice-president underwriting at Gard, prior to her current role.

06 / Nick Shaw, International Group

It has been a good year for the International Group, with — at least at the time of writing — only one pool claim two thirds of the way through the policy year, after two successive years of record payouts.

However, the reported $200m-plus deterioration in prior policy years will no doubt be cause for concern.

The pool scheme is the ultimate backstop for the major casualties that are unfortunately an unavoidable part of shipping life, which gives the IG an obviously crucial role.

The influential trade association is headed by Nick Shaw , a British lawyer who previously worked for Reed Smith. He has been in post since 2019.

07 / Paul Jennings and Jeremy Grose, NorthStandard

North Group and Standard Club will merge in February 2023 to form what is expected to become the world’s largest P&I club.

NorthStandard, as it will be branded, will have a slightly larger market share than Gard, the current leader.

The new entity will be jointly led by North’s Paul Jennings and Standard’s Jeremy Grose.

Mr Jennings graduated in law in 1984 and took a job with the Newcastle P&I Club, which merged with North in 1998. He became North’s chief executive in 2018 and is also outgoing chair of the International Group.

Mr Grose is also a law graduate, joining Standard Club’s manager Charles Taylor in 1991 as a claims executive, rising up the ranks to become chief executive in 2014.

08 / Clive Washbourn, Navium

Legendary marine insurer Clive Washbourn was asked why he launched his own firm, Navium Marine, in May 2021.

“Two words come to mind,” he replied. “One is ego and the other is latent ambition.”

That’s three words, actually. Yet Mr Washbourn’s standing in the sector is such that few would quibble. Other underwriters speak of him in hushed tones of admiration.

Mr Washbourn previously led a marine-based account at Beazley’s Lloyd’s syndicate 623 from December 1998, leaving in 2019 for unspecified personal reasons .

Before that, he had been active underwriter at ACE’s syndicate 375.

In his spare time, he is a horse-racing enthusiast and is a former racehorse owner.

09 / Ju-Ann Lee, Berkley Insurance Asia

Based in Singapore, Ju-Ann Lee heads the marine desk of Berkley Insurance Asia, providing coverage not only for cargo and hull but also marine liabilities.

She leads a team from two offices, one in Singapore where she resides, and another in Hong Kong.

Her more than two-decades-long experience as an underwriter, primarily in Asian and Middle East markets, has helped ensure the competence of her current employer of being a specialist in its region.

Before moving to her current position in 2016, Ms Lee was in charge of the Southeast Asia commercial lines team at Chubb, overseeing property and casualty as well its marine practice. She started her career at ACE Insurance.

Ms Lee has a B.Bus (Insurance) degree from Nanyang Technological University and is a chartered insurer of the Chartered Insurance Institute.

10 / Bjørnar Andresen, Gard

Gard is currently the world’s biggest P&I club, but it might not be for much longer. The impending merger of Britain’s North and Standard in February 2023 will create what will be a new standard-bearer for the niche.

However, the Norwegian marine mutual also accounts for around one-third of the Nordic hull market — now established as the world’s largest, thanks to the decline of Lloyd’s.

Gard’s P&I cover is, of course, provided on a not-for-profit basis, but Gard Marine & Energy is a fully commercial concern, with profits subsidising the mutual members.

As chief underwriting officer for both books, Bjørnar Andresen wields a considerable degree of clout in both sectors.

Mr Andresen served in the Norwegian navy between 1985 and 1999; he joined his current employer in 2010.

The Top 10 in marine insurance list is collated by the Lloyd’s List editorial team and considers a mixture of traditional power-brokers in an insular niche, as well as those doing noteworthy things within it

| Table |

|---|

|

|

Related Content

Top 10 maritime lawyers 2022, top 10 technology leaders 2022, top 10 box port operators 2022, top 10 flag states 2022, top 10 shipbrokers 2022, top 10 shipmanagers 2022.

- Top 100 People

- Ukraine crisis

- International

You must sign in to use this functionality

Authentication.signin.headsigninheader.

Your username does not meet the requirements.

Sorry - this email domain is not allowed.

Sorry - public email accounts are not allowed. Please provide a work email address.

An account with that username already exists.

Unfortunately we've not been able to process your registration. Please contact support.

Ask The Analyst

Please Note: You can also Click below Link for Ask the Analyst Ask The Analyst

Your question has been successfully sent to the email address below and we will get back as soon as possible. my@email.address .

All fields are required.

Please make sure all fields are completed.

Please make sure you have filled out all fields

Please enter a valid e-mail address

Please enter a valid Phone Number

Ask your question to our analysts

Email Article

All set! This article has been sent to my@email.address .

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Subject: Top 10 in marine insurance 2022

Add a personalized message to your email

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.

Sign In To Set a Search Alert

Finish creating your saved search alert after you sign in

Request Subscription

International Union of Marine Insurance

Press releases.

Positive development across all marine insurance lines of business continued in 2023, reports IUMI

16th September 2024 | Print version

Today, the International Union of Marine Insurance (IUMI) presented its analysis of the latest marine insurance market trends at its 150th annual conference in Berlin, Germany.

The global marine insurance premium base for 2023 was reported as USD 38.9 billion representing an uplift of 5.9% from the previous year. Development was seen across all lines of business with the Offshore Energy sector enjoying a 4.6% increase, Cargo insurance 6.2% increase and Ocean Hull 7.6% increase.

Distribution of premiums had not changed significantly from 2022 with Cargo commanding the largest share at 56.9% followed by Ocean Hull (23.6%), Offshore Energy (11.9%) and Marine Liability (7.7%). By region, Europe continued its dominance with a 48.5% share of global premiums followed by Asia/Pacific (28.1%), Latin America (10.9%), North America (7.0%) and the rest of world at 5.5%. Interestingly, after a period of decline, European premiums had enjoyed an upward trend since 2019 and the Asian market had also continued its rally since its downward trend ended in 2016. Latin and North America were also showing a modest upswing in their premium base.

Providing some context, Astrid Seltmann, Vice-Chair of IUMI’s Facts & Figures Committee, said:

“Global premiums reflect a combination of insurable volumes and prices per unit. The drivers for the increase in premiums are typically a continued rise in global trade volumes & values (cargo), coupled with increases in vessel values (hull), or the increase in oil price inducing more activity in the offshore energy segment. More widely, geopolitical conditions will have impacted premiums in a number of regions, as have general market conditions, specifically capacity. Overall, 2023 appears to have been a positive year for marine underwriters. The other part of the equation is the impact of claims which has been comparably benign over the past few years, despite individual severe claims giving rise to concern such as fires; and some visible inflation impact on the average cost of attritional losses. However, ever larger vessels, increasing value accumulations, changes in technology and fuels as well as changes to trading routes all mean a change of risk, which needs to be taken monitored and taken into account going forward.”

Offshore Energy

Global premiums in the Offshore Energy market were reported as USD 4.6 billion in 2023, a 4.6% uplift on 2022. The UK continued to dominate with the Lloyd’s and IUA markets accounting for a 28.2% and 36.8% share respectively.

The fortunes of this market tend to follow the oil price which appeared to have stabilised at a comparatively healthy level. This had driven renewed activity which, in turn, had led to positive market development. Premiums had rallied after reaching a low in 2019 and have continued upwards since then. The future trend will depend on the stability of the oil price and OPEC+ production decisions as well as insurance market capacity.

In recent years, claims were relatively low even though many offshore assets were being reactivated. However, 2023 saw two major losses and loss ratios (Europe) were starting out at a higher level than in previous years. Loss ratios in this sector take time to develop with no obvious pattern and so it is not certain how 2023 will play out. However, it is likely that 2023 will underperform when compared with the years 2020-2022.

Although day rates for offshore assets remained high, future performance of this sector will depend on oil price/production, weather events and market capacity. Similar to last year, a fragile balance between premiums and claims remains.

Cargo insurance returned a global premium base for 2023 of USD 22.1 billion – a 6.2% improvement on 2022. All regions experienced growth with Europe and Asia enjoying marked positive development. Overall, Europe claimed a 39.8% share followed by Asia/Pacific (32.2%), Latin America (11.9%), North America (7.5%), Middle East (6.0%) and Africa (2.7%). In general, premium growth in this sector follows global trade which had now normalised following COVID. The International Monetary Fund was predicting continued growth in world trade values, and this bodes well for cargo underwriters going forward, although such projections are subject to a considerable amount of uncertainty given the geopolitical situation. It should be noted that exchange rate fluctuations tend to impact most heavily on this sector, such that growth trends may deviate in local currencies and also make direct comparisons with earlier years more difficult.

Cargo underwriters suffered challenging loss ratios prior to 2019 but since then ratios have improved year-on-year. Although fires and floods have had an impact on claims, loss ratios for Europe in 2023 appeared to be more positive than in recent years. Loss ratios in other regions were also enjoying an improvement since 2019. The overall claims impact remained stable.

In general, Cargo insurance was enjoying improved results and a long-awaited period of positive stability. That said, a number of perennial issues will continue to impact including large vessel fires, mis-declared cargoes, accumulation of risk, severe weather events and geopolitical instability.

The Ocean Hull sector reported global premiums of USD 9.2 billion representing a 7.6% increase from the previous year. Europe commanded the largest share at 51.8% followed by Asia/Pacific (35.5%), Latin America (7.6%), North America (4.3%), Africa (0.6%) and Middle East (0.3%). The UK, China and Latin American markets had all experienced an increase in share during 2023 whilst the recent (and dramatic) rise in the Nordic market now appeared to have stabilised.

A return to normal shipping activity following COVID had a positive impact on vessel values in most classes and a higher demand for vessels had driven up the global premium base. This was particularly true for offshore support vessels whose values had risen significantly following a stable oil price and a reactivation of offshore activities.

Previously, there was concern over the large gap between total gross tonnage/number of vessels and global premiums which had opened markedly between 2011-2018. This gap began to close slightly from 2020 and, in 2023, had continued to reduce.

Following post-COVID reactivation, the frequency of hull claims showed some increase but had not yet exceeded pre-pandemic levels. Total loss frequency also showed a slight recent increase but remained at a very low level. The claim cost per vessel increased somewhat and in 2023, for the first time, exceeded the pre-COVID level. This was mainly due to increased major loss impact, particularly from costly vessel fires, which remains an ongoing issue.

Loss ratios (Europe) started at a higher point than the previous three years which might be attributed to a combination of an increase in claims coupled with the inflationary impact of repair costs. It is likely that 2023 loss ratios across most regions will be less positive than the previous two or three years, but better than the years prior to 2020.

Summing up, Jun Lin, Chair of IUMI’s Facts & Figures Committee said:

“Overall, 2023 was a positive year for marine underwriters with market development seen across all lines of marine insurance business. World trade continued to grow which impacted positively on the global premium base, particularly for cargo insurance. The oil price appears to have stabilised which is good for the offshore sector. Inflationary pressure has eased and many central banks are beginning to cut their interest rates. The claims environment was also relatively moderate in 2023 with no major weather events or vessel casualties making a significant impact on the overall costs, despite a few costly fires. Large vessel fires, particularly on containerships and car carriers, are still a major concern for hull and cargo insurers.”

“Increasing geopolitical tensions are creating headwinds for our industry and there seems no end to their impact in 2024 or beyond. The continuing Houthi attacks in the Red Sea area and the Russia/Ukraine war are disrupting traditional shipping routes and causing some carriers to change the way they operate. And we must not forget the tragic loss of life suffered by seafarers in those regions. Re-routing vessels around Africa brings additional risks but, so far, we have not seen any significant issue. On the flip side, these longer routes, particularly for containerships, have absorbed the influx of newbuilds into the market ensuring freight rates remain stable.”

“Other headwinds for 2024 and beyond will include the impact of the impending US election, climate change and associated extreme weather events, zero-carbon fuel technology and cyber-risks. But despite this, the marine insurance market has fared well in 2023 and I’m confident that marine underwriters will embrace future change with the same alacrity they’ve shown previously.”

IUMI’s total world-wide premium includes data from all relevant marine insurance markets. Care should be taken when making comparisons with earlier figures as data coverage varies in different years and a number of figures will be updated retrospectively. Similarly, the presented loss ratios for Hull, Energy and Cargo do not encompass all countries per region, and underwriting year results do develop over a couple of years due to a time lag in claims reporting and payments. When interpreting statistics, caution should always be applied regarding what the data actually relates to.

IUMI stresses that all figures released by IUMI’s Facts and Figures Committee are global market sums or averages. While these reflect the average performance of the marine insurance market, individual companies’ or countries’ results may differ substantially. As with all averages, individual underwriting units may over or underperform compared with the average. IUMI does not make any statements about what actual applied premium rates were or should be. The aim of IUMI is solely to provide data as available and raise awareness for the importance of a critical evaluation

of the risks covered.

The full presentation is available to download from www.iumi.com

For further information contact:

Mike Elsom

Phone +44 7968 196077

Email [email protected]

About IUMI The International Union of Marine Insurance e.V. (IUMI) is a non-profit association established for the purpose of protecting, safeguarding and advancing insurers‘ interests in marine and all types of transport insurance. It also provides an essential forum to discuss and exchange ideas, information and statistics of common interest for marine underwriters and in exchange with other marine professionals.

IUMI currently represents 42 national and marine market insurance and reinsurance associations.

Grosse Elbstrasse 36, 22767 Hamburg, Germany

Phone +49 (0) 40 2000 747-0

Email [email protected]

- Owners and Operators

- Supply and Agency

- Equipment and Services

- Classification Societies

- Ship Brokers

- Trade Finance

- Ship Finance

- Other Commodities

- Operational Efficiency

- Risk identification

- Compliance Adherence

- Data Services

- Seasearcher Advanced Risk & Compliance

- Seasearcher Trade Risk

- Predictive Fleet Analytics

- Seasearcher Risk & Compliance

- Seasearcher Container Tracker

Seasearcher Insurance

- Other Seasearcher Services

- Lloyd's List

Insurance Day

- Lloyd's Law Reports

- Marketing Solutions Marketing Solutions

- Risk & Compliance

- Trade, Trends & Technology

- Regulations & The Changing Industry

- Thought Leadership

- Data Storytelling

- Focused Webinars

- Our History Our History

- ISO 9001:2015

- Work With Us Work With Us

- Announcements Announcements

- Product Catalog Product Catalog

- Contact Us Contact Us

- Supplier Code Of Conduct Supplier Code Of Conduct

- Search Site

- Search by Keyword

Loss Prevention Lead / Leading International Insurance Company

Our solutions in depth

Maximise profitability, confidently set pricing models and protect your business from any connections to sanctioned activity with a suite of intelligent online tools specifically designed to help you spot and assess risk.

Lloyd's List

Stay well-informed of the constantly changing industry and what it means to businesses and markets with curated news, commentary and analysis in the form of daily news articles and briefings, weekly and monthly digests, monthly magazine, podcasts, webinars, and market outlook reports.

Seasearcher Advanced Risk & Compliance

Access the new standard in sanctions compliance risk analysis Seasearcher Advanced Risk & Compliance gives you a level of insight previously unattainable, enabling you to save time and effort completing sanctions compliance checks, investigations and monitoring vessels for illicit activity.

Get an unparalleled view of the market, how it's changing and how the major players are responding with access to news, analysis and verified data from the world’s leading source of insurance industry insight.

Data services

Integrate the most complete and trusted near-time and historical maritime data straight into your systems and platforms. Our vessel characteristics and activity data can merge seamlessly and streamline your workflow.

Thank you for requesting a consultation

We have received your request and we will get back to you soon.

Request a Consultation

Terms and Conditions

Privacy Policy Terms & Conditions

Thanks for getting in touch

For general enquiries, please contact us below, thank you for providing your details.

Your request is being processed.

Please complete your details

Tems and Conditions

We will call you back as soon as possible.

Request a callback

Thank you for requesting a demo, request a demo.

You will receive a confirmation email with access details

Please register your details

We use cookies to help provide you with the best possible online experience. Please read our Privacy Policy and Terms & Conditions for information about which cookies we use and what information we collect on our site. By continuing to use this site, you agree that we may store and access cookies on your device. Cookie Policy

Cookie Preference Center

When you visit any website, it may store or retrieve information on your browser, mostly in the form of cookies. This information might be about you, your preferences or your device and is mostly used to make the site work as you expect it to. The information does not usually directly identify you, but it can give you a more personalized web experience. Because we respect your right to privacy, you can choose not to allow some types of cookies. Click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience of the site and the services we are able to offer.

Manage Consent Preferences

Strictly necessary cookies, performance cookies, functional cookies.

This site uses cookies. You can read how we use them in our privacy policy .

- Company Profile

- Testimonials

- Additional Coverages

- Broker Enquiries

- Latest News

At Superyacht Insurance Brokers we have extensive experience in the Lloyd’s and London International Marine Insurance Marketplace.

Our many years of experience doing business with Lloyd’s of London and other London based international marine underwriters has provided us with very broad and extensive access to the best, most reputable and most experienced underwriters at Lloyd’s and other global marine insurance underwriters in the city. For qualified brokerages we can arrange full Underwriting, Binding & Issuing Coverholder Authorities . We can also accommodate Open Market Placement of individual yacht and marine risks into the market.

+44 203 053 8612 “>Call us on +44 203 053 8612 or email us at [email protected] to explore how we can help you increase your product and services depth, create efficiencies and increase profitability. We come from a long & strong background owning & operating retail insurance brokerages in North America. We understand your business and customer needs as well as your business flows and daily challenges – we can help on many levels.

Office: +44 (0)20 3053 8612 [email protected]

32 Threadneedle Street London, United Kingdom EC2R 8AY

EMERGENCY 24 HOURS

+44 (0)20 3053 8612

Connect with us on Social Media

DISCLAIMER: All insurance policies are unique and specific in their coverage limits, terms and conditions. None of the descriptions of coverage in this website effect your specific policy terms in any way.

Superyacht Insurance Brokers Ltd is Regulated and Authorised by the Financial Conduct Authority – FRN 844548

This site uses cookies. You can read how we use them in our Privacy Policy

ALL RIGHTS RESERVED © SUPERYACHT INSURANCE BROKERS LTD 2024. WEBSITE DESIGN: PAD CREATIVE

156 queries in 1.463 seconds.

Dream Makers & Yacht Brokers

Helping turn your dreams into reality since 1984.

Preferred Yachts Display Center

Visit us at the harborage marina in charming downtown saint petersburg.

Get Results, List With Us

Since 1984, preferred yachts has earned a stellar reputation, one client at a time.

A Yacht Show Every Day

Explore in person 7 days a week or virtual tours online, 24 hours a day.

Take a 3D Virtual Tour of Our Listings

View our listings from the safety and comfort of your home.

Power or Sail - Big or Small

Explore one of florida's largest displays of brokerage yachts.

3D Virtual Tours, Display Center.

5 Reasons to list with us.

Our Team is Awesome!

Office Hours

OPEN MONDAY – SATURDAY, 9am – 5pm Sunday, by appointment

Information

Call (727) 527-2800 Put our Awesome Team to work for you

The Preferred Yachts Difference

We are full time professional yacht brokers, with a real office, in a real marina with real listings and a sincere passion to help our clients realize their boating dreams. Preferred Yachts is committed to the highest level of ethical, professional and knowledgeable representation for our clients.

Our Team is Awesome at Listings and Sales

Our membership in The IYBA is your assurance of professional and ethical representation as well as fair and standardized Listing and Selling Agreements. Through IYBA, We have a cooperative relationship with the best brokers in the business in order to find a buyer for your yacht or to find your next one.

Connect with Preferred Yachts

Harbor Insurance Group

Get a quote.

- Auto insurance quote

- Home insurance quote

- Condo insurance quote

- Renters insurance quote

- Free insurance quotes

Don't worry about your insurance. That's our job.

Harbor Insurance Group is one of the leading independent insurance agencies in St Petersburg, FL. Being an independent insurance agency, we offer car insurance, home insurance and business insurance from 20 different insurance companies. These companies range from national providers such as MetLife and Progressive to regional providers that can tailor a policy just for you. Our experience with all of these companies can help you find the policy that suits your needs at a cost that fits your budget

Commercial insurance is a complex field as there are so many types of businesses and so many aspects to any one business. Workers comp, general liability, bonds, and fleet auto insurance are just a few categories that a business may need to consider for their business insurance coverage. Harbor Insurance Group is in business for business, so we know how to tailor a business insurance plan to meet the needs of any company in the St Petersurg area.

But business is not our only specialty. Many lines of personal insurance are available from Harbor, from home owners insurance to auto insurance to life insurance. And we certainly wouldn't be able to honor our name if we didn't offer boat insurance as well, to the many residents of St Petersburg who take advantage of the beautiful waters off our coast.

If you happen to be in zip code 33702, stop by our office for a free consultation. Or call today to answer any insurance question.

Insuring Your Car How much car insurance?

How do you know if you have the right coverage? Request a quote or call us to get a plan that's as unique as you are.

Homeowner Insurance Does your home have enough?

Make sure you have enough coverage on your home. Know what you'll need in your area. We can help. Request a quote online »

News // Essential Safety Gear for Motorcyclists: A Guide to Protection on the Road

Quality insurance coverage you can trust.

We work with some of the the largest and well respected insurance companies. We will find the best rates and coverage for you.

Our Insurance Companies

Additional navigation:, navigation:.

- Our Insurance Products

- Professional Liability

Glossary and acronyms

Insurance terms.

Explore our glossary of insurance related terms used by the Lloyd’s Corporation and market participants.

Please note that the definitions are intended for general guidance and they do not override or qualify any definition that appears in any Lloyd’s byelaw or regulation, in any contract or in any other document.

IMAGES

COMMENTS

Lloyd's International Trading Advice are the primary point of contact for advice and information on Lloyd's trading status worldwide. +44 (0)20 7327 6677 [email protected]. ... Lloyd's is the world's leading insurance market providing specialist insurance services to businesses in over 200 countries and territories.

The Atlass Seawave Yacht & Boat Insurance Program provides insurance coverage underwritten by Lloyds of London. The Seawave program is designed for the recreational boater and provides boat insurance coverage directly to yacht owners and insurance agents & brokers. This insurance program is designed for select North & Central American cruising ...

Millie joined Navium in November 2021 from the Lloyd's of London Insurance Graduate Scheme. She undertook placements in the Lloyd's Corporation, Canopius, and Marsh Marine Teams and completed her ACII. Millie graduated from the University of Cambridge with a BA in Anglo-Saxon, Norse and Celtic History and an MA from Newcastle University in ...

Welcome. Global Yacht Cover is an underwriting facility offering yacht insurance with 100% Great Lakes Insurance SE security. We insure all types of sailing yachts and motorboats globally, valued up to £10,000,000. Whether you are day sailing in local waters or setting off on an adventure of a lifetime around the world - Global Yacht Cover ...

According to a number of sources, the Lloyd's superyacht insurance market has been running on an unsustainable loss ratio. For a number of years, the Lloyd's market operated at about 120 per cent loss ratio. In 2015 the Lloyd's market collected around £150million of premium and operated at a loss ratio of 140 per cent, meaning that it ...

We are authorised and regulated by The Financial Conduct Authority in the UK. www.fca.org.uk ref. no. 312786. We are licensed Lloyd's Brokers - www.lloyds.com Seascope Europe S.M.P.C. is registered in Greece as an insurance and reinsurance intermediary regulated by the Bank of Greece registration number 156933509000, with its registered office at 89, Papanastasiou Str, Kastella, 185 33 ...

Seawave Boat and Yacht Insurance underwritten by Lloyd's of London. Florida, Bahamas, and Caribbean Marine Insurance. An Atlass Insurance / Risk Strategies Company. The SOLUTION for Year Round Windstorm Navigation Insurance Requirements. Boat Owners +1 800.330.3370. Insurance Agents

06 / Rama Chandran, QBE. While Europe retains the top three markets in hull insurance, Asia is catching up fast. Leading the way in its emergence is Rama Chandran, head of marine at QBE. Mr Chandran started his career as chief engineer on tankers.

From mega yachts, motor, sailing, trawler and sports fishing yachts, the Travelers Yacht team is one of the leading providers of specialist Yacht insurance in the Lloyd's market with a reputation for creative and customised solutions and claims expertise. Our experienced Yacht underwriters have a high degree of specialist industry knowledge ...

Global marine insurance premiums grew by 5.9% to $38.9bn in 2023, driven by a combination of increased insurable volumes and improving rate, according to the International Union of Marine ...

Hull covers physical damage to the vessel and its appurtenances, while P&I is marine liability insurance for third-party liability, explains Poppe. The larger the yacht and/or the more complex its cruising programme, the more likely this coverage will be split with P&I provided by a P&I Club. "They offer a single shot $500 million P&I limit ...

Lloyd's List. Marine insurance has been well to the fore in 2022, providing war risk cover for both ships and cargo carrying vitally needed grain from Ukraine to markets in the developing world, as well as day-in, day-out P&I and H&M policies. McGill: Launched a $50m marine cargo and war risk facility that proved a vital lifeline.

Combining our extensive yacht insurance management experience with a lifetime of worldwide sailing and yachting, along with our very broad access to yacht insurance underwriting experts at Lloyd's of London and other global yacht insurance underwriters - we naturally become the best choice for discerning luxury superyacht owners, managers ...

The Lloyd's Agency Network provides 24 hour, year round independent marine surveying and claims adjusting services to the global insurance industry and its customers. Lloyd's Agents are appointed by Lloyd's to supply local shipping information and casualty intelligence, to provide surveying and, in most instances, claim adjusting services to ...

That's why we have our own in-house risk control and claims expertise and also collaborate with other areas of Travelers to address your non-marine exposures. We offer a wide range of marine insurance products; Cargo, Energy, Fine Art & Specie, Hull & Marine, Liability, Marine Professional Indemnity and Logistics, Ports and Terminals, Terrorism ...

One Florida yacht broker agreed that having a Lloyd's- or ABS-classified yacht would encourage most insurance companies to offer lower rates but, at the same time, the owner would pay more than he saved in maintaining the classification and having the annual survey so the ultimate out-of-pocket expense would be higher.

The global marine insurance premium base for 2023 was reported as USD 38.9 billion representing an uplift of 5.9% from the previous year. Development was seen across all lines of business with the Offshore Energy sector enjoying a 4.6% increase, Cargo insurance 6.2% increase and Ocean Hull 7.6% increase. ... a 4.6% uplift on 2022. The UK ...

Arm yourself with the right tools to manage risk and drive profitability. Access news, analysis and industry commentary. Track vessel movements. Understand vessel ownership characteristics. Access an unbiased view of vessel history and risk. Monitor incidents, casualties and sanction breaches. Monitor and track illicit behaviour.

At Superyacht Insurance Brokers we have extensive experience in the Lloyd's and London International Marine marketplace. We can arrange full Lloyd's Underwriting & Issuing Coverholder Authorities or place individual Yacht Insurance or Marine Insurance risks.

If your boat causes injury to others or damage to other boats, docks, or structures, boat liability insurance can help you.1 Injury or damage can be due to direct contact with your vessel or situations caused by your vessel, like large wakes. Boat liability coverage may provide protection against lawsuits, including the payment of settlements and legal fees.

Marine insurance therefore predated the era of British colonial slavery (which began c. 1625), but the rise of Lloyd's from the original coffeehouse (1688/9) to the establishment of New Lloyd's (1771) and the subsequent consolidation of its position as the leading market for marine insurance coincided with the emergence of Britain in the ...

Preferred Yachts is committed to the highest level of ethical, professional and knowledgeable representation for our clients. Call 727 (527)-2800 Our Team is Awesome at Listings and Sales. Our membership in The IYBA is your assurance of professional and ethical representation as well as fair and standardized Listing and Selling Agreements ...

That's our job. Harbor Insurance Group is one of the leading independent insurance agencies in St Petersburg, FL. Being an independent insurance agency, we offer car insurance, home insurance and business insurance from 20 different insurance companies. These companies range from national providers such as MetLife and Progressive to regional ...

St. Petersburg Yacht Sales and Service 727-823-2555. St. Petersburg Yacht Sales and Service has been serving customers since 1964 and is located in downtown St. Petersburg. We are close by the St. Petersburg Municipal Marina where we have some of our many brokerage boats on display.

Latin for from the beginning. The calendar or accounting year in which a loss occurs. The process by which a firm may obtain registration as a Lloyd's broker. A Lloyd's broker. The individual at the underwriting box with principal authority to accept insurance and reinsurance risk on behalf of the members of a syndicate.

Progressive Home in St. Petersburg, Florida. 1 ASI Way N., St. Petersburg, FL 33702. Get directions. 1-855-347-3939. Outside of normal operating hours, representatives are available 24/7 for you to report a claim or ask questions about your policy.