The Ultimate Guide to Yacht Insurance in Hong Kong

Everybody wants a taste of the luxurious life, and some are lucky enough to enjoy it. Luxury is “a state of great comfort or elegance, especially when involving great expense.” People work hard and smart to gain those luxury perks, even if it is just for a few days. In a city like Hong Kong, many can afford a luxurious life and enjoy it through various assets such as big houses, vehicles and more.

One of these assets includes yachts. Those beautiful boats that we see when we look over the harbour. It is a well-known practice in Hong Kong to rent yachts from the owners or businesses and enjoy our luxury life for a few hours (charter). However, owning a yacht comes with many risks in Hong Kong due to the weather, crowded docks, expensive equipment and more. Therefore, yacht owners must be conscientious when renting or using their yachts. The outcome of these risks can be costly and would have a damaging effect on their luxurious life.

Risks and consequences are why Yacht Insurance is crucial to any owner of the yacht(s). Especially in a city like Hong Kong, yacht insurance can save the owner a large sum of money and help them during challenging situations the yacht may experience. This article will accurately explain why yacht insurance is essential and the factors that affect the insurance.

What is Yacht Insurance?

A yacht can range from about 10 meters up to 50 meters in length. Most yacht sizes fall in the middle. Any vessel over 50 meters is known as a -Superyachts. Owners can use yachts for either racing, travelling, charters or pleasure.

Yacht insurance, also known as boat insurance , is a luxury policy that provides protection and services at any time for the vessel and the valuables associated with the yacht. Much like car insurance, third-party liability protection is mandatory when an owner buys a yacht. The protection is a must for such vessels in Hong Kong due to typhoons, the number of boats in the sea and unpredictable situations an owner may face. In addition, the insurance will repair or replace your yacht and provide emergency towing.

The insurance company can also tailor the insurance to insure boats and provide similar coverage.

The Best Coverage Of Yacht Insurance Cover

Protection against unpredictable events.

We all know some incidents are drastic and unpredictable, ranging from weather crises to uncontrolled fires. These incidents can be a significant risk to a yacht, and the owner, as a typical typhoon 8 in Hong Kong or a surprising fire could result in severe damages to the yacht and high repair costs.

In Hong Kong, typhoons are regular from July to October; they result in harsh seas and blustery wind. In these situations, owners fear for the safety of their yacht and hope there is no damage. Owners can still avoid the force of a typhoon due to shelters and practice, but fire is something that can never be predicted or avoided.

For example , in June 2021, in Aberdeen, Hong Kong, a shocking fire at the typhoon shelter spread all over the stationed vessels, sunk at least 20 yachts/boats and damaged 12 plus. These disasters can cause significant financial damage to the owner and take weeks to repair.

In these situations, the best solution is to have yacht insurance beforehand. Yacht insurance will cover the yacht damage caused by these unpredictable events. In addition, the insurer will provide the cost of repair or replacement to the owner as soon as possible. Although, if the observatory has hoisted or expects to hoist the typhoon signal no. 3, many yacht insurance policies will expect the owner to park their boats at the typhoon shelter within a specific time as stated in the terms; otherwise, the insurer may reject their claims. The insurance can save the owner of the yacht a large sum of money and time and allow them to remain calm during typhoons.

Post Accident Support

Accidents can happen anywhere, whether on the road or on the ocean. If you think parking your car is tricky, parking a 10-meter vessel can be one of the greatest challenges in the sea. Small boats, fishing vessels and many other yachts crowd most docks in Hong Kong. Accidents can happen anytime during docking or even while sailing on the harsh sea. A personal accident can result in damages from scratches to the engine needing immediate repair or worse.

An example of a damaging accident is when a yacht carrying 37 passengers lost control at night while leaving Sai Kung Public Pier, Hong Kong. It crashed into the pier near the lighthouse and then was stranded on the breakwater nearby. The body (Hull) of the yacht was damaged and could not move anywhere.

These kinds of events can be scary and costly, especially at night. When the owner has yacht insurance, they will worry less when facing these situations. The insurance will pay for repairing the damages caused by the accident and may even replace parts when needed.

When insured, the services will be quicker , too; high-quality yacht insurance will inspect and pay the owner within only two days. Additionally, when insured by yacht insurance, the owner can make one call to the insurance company, and they will provide towing services immediately. These factors are why owners must purchase high-quality yacht insurance for a safer future.

Third-Party Damage

Accidents damage the owner’s yacht and cause severe damage to the pier, other boats, and, most importantly, the passengers. It is the yacht owners’/business’s worst nightmare when they are getting blamed by a third party for a large amount of damage. It can cost a significant amount and result in the third party suing the owner. Third-party damage can also damage the environment due to oil spilling from the yacht, which will break the pollution law and result in the government suing the yacht owner.

Regarding the previous example, the yacht that crashed into the pier, the government could ask the yacht owner to pay for the damage caused to the dock and possible lawsuit as there could be an oil leak when the hull was damaged.

Yacht insurance will protect the owner from most third-party claims and provide the cost of third-party repair or compensation. The insurance will protect the owner from financial loss and also help settle damage lawsuits . However, basic yacht insurance will not cover cases due to owners breaking the law, such as environmental pollution. High-quality yacht insurance will provide legal defence costs, pollution liability coverage to the owner to defend themselves against harming the environment and costs to solve the environmental damage caused.

Emergency Services

As you can imagine, there are no service stations or convenient shops on the ocean when travelling on a yacht. Therefore, a small or big emergency can be an awful situation, and at times one may not know what to do. Especially during the night times, it is almost impossible to spot nearby boats and get assistance. The only option is to call the Coast Guard, which can take time and cost the owner an additional amount.

In all the examples mentioned above, the boats would need to be towed to shore to be repaired or inspected. Additionally, yacht insurance makes that fear disappear instantly, as when one buys yacht insurance, they can give the insurer a call, explain the situation and get towed at any time.

The insurance company will contact the nearest towing company and arrange everything needed with no payment on the policyholder’s side. Additionally, suppose an owner feels they will not be able to reach the typhoon shelter during that upcoming typhoon due to an accident or poor operational engine. In that case, the insurer will provide towing services to the yacht as soon as the owner has informed them. Furthermore, the insurance can contact people who can also offer a yacht oil and battery change service while on the water. All these services make the owners’ life much easier and stress-free when in an unpleasant situation.

Factors That Affect Yacht Insurance Premium

A few factors may affect the insurance premium and the coverage they can provide for the yacht owner. These factors are:

- Purpose of the Yacht : The policyholder can use the yacht for various purposes such as racing, pleasure or long-distance travelling. Each purpose has its risks, which an insurer will need to evaluate. For example, more people interact with the boat when an owner/business rents out yacht(s) for charter. Hence yachts that owners charter will have a higher premium as the risks increase with the number of people using the vessel.

- Age of Yacht : The older the yacht is, the higher the risks of breakdown and need for repair. Therefore the owner will need to pay a higher premium the older the luxury boat.

- Yacht Size : In this case, size does matter, as the bigger the boat, the more risks it could face while docking or travelling through narrow ways. Also, bigger boats can carry more passengers, increasing the liability risks. Hence the premium for larger yachts or superyachts will be higher compared to smaller vessels.

- Yacht Condition : The owner will have to explain their experience in sailing and whether the yacht has been in any accidents in recent years. The owner will need to provide a detailed history of the vessel to help calculate the accurate premium.

Additional Benefits Of Yacht Insurance

High-quality yacht insurance will provide the vessel owner with the best connections needed during an emergency or an annual repair. In addition, with yacht insurance, the owner will feel safe knowing that the insurance company will use their experience to provide the owner with expert connections at any time.

Another brilliant aspect of high-quality yacht insurance is that it will protect the valuables on the yacht or affiliated to the yacht experience—for example, water sports and fishing equipment. In addition, the insurance will repair or replace the value that may be damaged or stolen during the use.

Insurance companies will provide quick solutions to any emergency regarding the yacht. An expert yacht and boat insurance provider will solve the issue within 48 hours and first make sure that you and the passengers are safe. The insurance provided will inform the policyholder step by step on what should be done to fix the possible problem. Won’t stop till the case is solved.

To Learn More about y acht insurance and boat insurance and get the best coverage for your yacht or boat, contact Red Asia Insurance .

Ask One of Our Insurance Specialists!

We’re here to help answer any of your questions. Insurance is a large and complexe topic. Our experts aims to assist you and ease the process whatever your industry is.

Your Name (required)

Your Email (required)

Your Message

Share This Story, Choose Your Platform!

Related posts.

Reasons To Insure Your Watch & Clock

Reasons To Insure Your Wine Investment

Most Common Injuries in Hong Kong

Importance of Home Insurance During Summer in Hong Kong

Overseas Student Insurance: Protect Your Child Abroad

- Argentina(Español)

- Österreich (Deutsch)

- Belgium(English)

- Belgique (Français)

- België(Nederlands)

- Brasil (Português)

- Canada(English)

- Canada (Français)

- Chile(Español)

- China(Chinese)

- Colombia(Español)

- Czechia(Czech)

- Denmark(Danish)

- República dominicana(Español)

- France (Français)

- Deutschland (Deutsch)

- Hungary(Hungarian)

- Italia(Italiano)

- Kazakhstan(Kazakh)

- Kazakhstan(Russian)

- Luxembourg(Français)

- Mexico(Español)

- Maroc(Français)

- Nederland(Nederlands)

- Panamá(Español)

- Perú(Español)

- Poland(Polish)

- Portugal (Português)

- Puerto Rico(Español)

- Romania(Romanian)

- Slovakia(Slovak)

- España (Español)

- Taiwan(Chinese)

- Tunisie(Français)

- Turkey(Turkish)

- Ukraine(Ukrainian)

- United States(English)

- Uruguay(Español)

- Venezuela(Español)

Marsh YachtCover

Comprehensive and flexible coverage options at highly competitive pricing

Fast processing time, presented in days

Brokers and claims specialists with over 75 years of experience

Across Asia, yacht owners know the importance of insuring their vessels, which enables access to marinas, indemnifies against third-party liability and damage, and offers protection against a wide range of natural and man-made risks that can potentially incur high costs.

However, yacht insurance policies vary widely and obtaining the right level of cover can be difficult. How do yacht owners select from the range of yacht insurance options available and secure the correct level of coverage to protect their prized assets?

Introducing Marsh YachtCover

Marsh YachtCover helps yacht owners identify and obtain the optimal level of yacht insurance cover at highly competitive pricing and market-leading terms via an online quotation web portal. We provide end-to-end protection and support for yachts — including claims assistance and management following an accident — and coverage that is tailored to your profile and needs. Marsh YachtCover’ s service goes above and beyond the typical insurer at no additional expense while helping you save, on average, 10% on your premiums.

Marsh YachtCover is specially curated for pleasure yachts registered in Asia and/or sailing within Asia valued between US$500,000 and US$18million. Coverage for higher-valued yachts and/or a wider geographical coverage are also available—please contact our yacht specialists .

Marsh YachtCover Features

Coverage features include (but are not limited to) the following:

- Replacement Cost Loss Settlement : Pays for repairs or replacement of covered property without deduction for depreciation for most partial losses.

- Medical Payments: Covers reasonable medical and related expenses on a per person basis for all on-board, boarding or leaving the insured yacht.

- Emergency Assistance : Pays for the costs incurred when emergency assistance is required, even if you and your yacht are not in immediate danger.

- Uninsured Boater Coverage: Pays for bodily injury to persons aboard the yacht who are injured by an uninsured owner or operator of another yacht.

- Bottom Inspection : Pays for reasonable costs incurred to inspect the bottom of the yacht after grounding, stranding or striking a submerged object, even if no damage is found, without application of any deductible.

Benefits of Marsh YachtCover

A fast and easy online submission process, broad and flexible yacht insurance coverage options presented to you in days, highly competitive pricing, peace of mind from a-rated international insurers, reliable service from a team of experienced brokers and claims specialists.

The above information is intended as a general summary and is indicative of the key features of an insurance plan. Full policy wording should be referred to for full details of benefits, exclusions, and requirements. A copy of the policy wording will be provided with our quotation.

Am I required by law to purchase yacht insurance?

Different territories have varying rules and regulations with regards to boat insurances. Please check with your local authorities on the insurance requirements.

Singapore The Maritime Port Authority of Singapore requires all yacht owners to have an insurance policy before they can issue a pleasure craft license.

Hong Kong It is mandatory for all boat owners in Hong Kong to purchase boat insurance which covers the liability for death or bodily injury to third parties.

Malaysia Like land transport vehicles such as cars and trucks, all water transport vessels registered in Malaysia needs to have insurance issued in Malaysia.

Taiwan According to The Law of Ships in Ministry of Transportation and Communications, all yacht owners are required to purchase insurance covering the liability for death or bodily injury to the passenger.

Thailand According to Thailand commercial boating laws, any boat that carries passengers, must have compulsory passenger insurance.

Do I need to purchase separate policies to cover my yacht as well as any liabilities to third parties?

No, you do not. Marsh YachtCover offers the option of combining both policies, providing coverage for the loss of, or damage to, the yacht as well as liabilities to third parties.

Under the Hull and Machinery (H&M) section, the physical damage section covers the loss or damage to the boat and its machinery — including the hull, engines, sails, personal property, and equipment necessary to operate the boat.

The liability section, sometimes referred to as Protection & Indemnity (P&I), covers your legal obligations to other parties, such as bodily injury, loss of life, pollution, or damage to a third party property while the boat is operating or under your ownership.

If you do not require H&M insurance, Marsh YachtCover also offers the option of a standalone liability policy.

How is the premium calculated for yacht insurance?

Insurers generally consider various factors when determining the premium to charge for your yacht insurance. This includes but is not limited to the following:

i. General boat characteristics: value, length, age, material of hull, make type and number of engines.

ii. Skipper’s experience

iii. Mooring details

iv. Claims record

v. Deductible amount

vi. Navigational limit

vii. Limit of third party liability

viii. Additional safety equipment

ix. Recent survey reports

How do I file a claim?

In the event of a claim, policy holders need to report the incident immediately. You will need to download and submit the Marsh YachtCover claims form with any supporting documents to your broker.

Read our article ‘ A hassle-free guide to filing a yacht insurance claim ’ to learn more about the claims process.

How much should I insure my yacht for?

Insurers generally accept an owner’s estimate of the value of a yacht, which should reflect current market value. It is accepted that the practical method for an owner to estimate value is by giving the purchase price, unless particular factors support a different view, such as if the boat is put up for sale or a professional valuation has been obtained.

You are not obliged to have your yacht valued prior to obtaining or renewing insurance, nor is it customary for insurers to make such a request. You should, however, ensure that you are clear about the meaning of ‘market value’ and other similar terms in proposal forms and policies, and be mindful of the importance of disclosing all material information.

Marsh YachtCover accepts yachts valued above US$500,000 and up to a maximum of US$18 million.

Read our article ’ Yacht Insurance - what every owner should know ’ to learn more.

Is there a deductible?

A deductible is an amount the insurer will subtract from a loss before paying the claim amount up to the policy limit.

Marsh YachtCover typically uses an “Agreed Value” wording, meaning your insurer will pay the entire agreed amount of the yacht, with no deductible, in the event of total loss.

In the event of a partial loss, cover is generally on a new for old replacement basis, except for materials that are subject to higher levels of normal wear and tear such as sails and covers of canvas or other like materials, in which case there may be an allowance for depreciation.

Insurers are liable only for the reasonable cost of repairs.

What limit of liability should I buy?

Some territories, for example Hong Kong, have a mandatory minimum limit for third-party cover — check your local regulations. Also check with your marina or those that you wish to call for guidance, as they too may have minimum insurance requirements.

Marsh, the world’s largest insurance broker and risk advisor, is dedicated to helping clients globally and in Asia manage risk effectively. Leveraging strong historical relationships with global carriers and robust technology and data capabilities, Marsh’s long-standing expertise in designing, developing, and implementing innovative and efficient risk solutions across diverse industries and geographies delivers sustainable benefits for clients and empowers them to take advantage of opportunities that foster resilient business growth and expansion.

Essential information on yacht insurance

Yacht Insurance – what every owner should know

A hassle-free guide to filing a yacht insurance claim

Are there benefits to using a yacht insurance broker?

Tom Chan

Divisional Director, Marine – Yachts

Venture out to sea with confidence

- +852 2114 2840

- Individuals

- Emergency Evacuation

- Alternative Therapy

- Newborn Child Insurance

- Deductibles and excesses

- Waiting Periods

- Coverage Areas

- Business Packages

- Business Contents

- Cargo and Shipping

- Cyber Risks

- Directors and Officers

- Employee's Compensation

- Pilot's Loss of License

- Professional Indemnity

- Public Liability

- Trade Credit

- Business Interruption

- Commercial Goods Liability

- Medical Negligence Insurance

- Whole of Life

- Key Man and Group Life

- Non-Traditional

- Premium Waiver

- Disability Income

- Personal Accidents

- Medical Benefits

- Insurability Benefits

- Inflationary Adjusted

- Accelerated Death Benefits

- Entire Contract Provision

- Incontestability Provision

- Grace Periods

- Beneficiary Designation

- Nonforfeiture Benefits

- Policy Loans

- Policy Reinstatement

- Misstatement of Age and Sex

- Dividend Options

- Settlement Options

- Suicide Exclusions

- Medical Reports

- Premium Types

- Policy Type

- Insurable Interest

- Application Procedures

- Cooling Off Periods

- Insurance Explained

- Personal Collections

- Home Plus Art

- Corporate Collections

- Museums and Galleries

- Corporate Events

- Charity Events

- Sporting Events and Tournaments

- Fairs and Exhibitions

- Third Party Plans

- Comprehensive Coverage Plans

- High End and Luxury Vehicle Plans

- Commercial Vehicle Plans

- Motorbike Plans

- General Home Insurance

- Fire Insurance

- Specialist Insurance Products in Hong Kong

- Hong Kong Yacht Insurance

Introduction

Marine hull and yacht insurance in hong kong.

Yachts and other marine vessels are extremely expensive, and operating in the open water can present a range of risks not present on land. If you own a marine pleasure craft in Hong Kong then it is important that you ensure your investment is protected.

CCW Global is able to assist all Yacht and marine pleasure craft owners in finding comprehensive coverage for their vessels. Whether it is a traditional sail yacht, a motor-driven luxury cruiser, or even a simple junk boat, there are many options for owners to consider when it comes to protecting their interests at sea.

From having your craft stranded during a typhoon, an accidental fire starting in the galley while at sea, or a navigation error causing you to collide with another vessel, Marine Hull and Yacht Insurance can provide owners with peace-of-mind that they have the protection they need in a worst case scenario.

Marine Insurance Coverage in Hong Kong

Marine 3rd party insurance.

Under Hong Kong law it is compulsory that all vessels operating in local waters possess a minimum level of 3 rd Party insurance protection, covering their risk of causing accidental injury, death, or property damage to third parties.

For vessels permitted to carry 10 or more passengers this is HK$ 10,000,000, for certificated local vessels permitted to carry fewer than 10 passengers they must hold a minimum amount of HK$ 5,000,000 in third party liability insurance protection.

Most Yacht insurance packages in Hong Kong will include the statutory minimum levels of coverage as required by the Marine Department, and it is possible to obtain marine pleasure craft insurance which only provides 3 rd party protection.

The premium associated with this type of benefit will depend on the age of the vessel, its certification category, whether the craft is being used for commercial or pleasure purposes, and where the moorage is located

Marine Hull Insurance

Often provided as “extra coverage” for an additional premium, it is possible to obtain a Yacht insurance policy which includes Hull and Machinery protection. This safeguards the costliest items on your vessel against losses stemming from latent defects, repair yard negligence, fire, heavy weather, theft, or even malicious damage.

Many Marine Hull and Machinery insurance options will provide “New for Old” replacement of electrical and mechanical parts on your vessel which are less than 5 years old. Further to this, it is possible to obtain a policy which waives all deductible costs for damages caused by third parties if your vessel is damaged while berthed in its usual marina.

Even if you have an older vessel which has proven to be a challenge to insure against hull or mechanical risks, there may be options available in exchange for an increased premium.

Marine Extra Perils Insurance

Operating any vessel at sea carries risks. For the yacht owner who wants full protection of their vessel and maritime activities it is possible to obtain fully comprehensive pleasure craft insurance in Hong Kong. Under a fully comprehensive Hong Kong Yacht Insurance policy coverage could include protection for:

- Social Yacht Racing and Yacht Racing

- Voluntary Rescue Work

- Trailer and Transit Risks

Obtaining full coverage for all possible extended risks under a Hong Kong Marine Insurance policy will carry a higher premium than choosing the only the mandatory 3 rd party protection, but the peace-of-mind provided to an owner knowing they are fully protected can be invaluable.

Marine Crew Employees’ Compensation Insurance

One of the most critical components to the successful operation of any vessel is the crew.

Under Hong Kong law any individual or company employing any person to work in any capacity must hold Employees’ Compensation Insurance Protection. Also known as EC Insurance, this type of coverage protects an employer’s liability towards workers who suffer an accident or injury in the routine course of their employment.

As crewing a vessel is often considered a “high-risk” occupation it can be a challenge for owners and crew in Hong Kong to obtain the required levels of Employees’ Compensation Insurance coverage. In some cases, CCW Global may be able to assist.

Free Marine Hull and Yacht Insurance Quotes

If you would like to receive a free quote for insurance of your yacht or marine pleasure craft in Hong Kong, simply complete the short form located here and one of our expert brokers will contact you to discuss the insurance solutions which best meet your needs.

Alternatively, to learn more about our no-cost, no-obligation quotation process, or to learn more about your Hong Kong marine insurance options, Contact Us Today .

Ask CCW - We're Simplifying Your Insurance.

We have received your enquiry, it may take us 1-2 working days to respond to your enquiry. In case of urgent assistance please call our office at (+852) 2114 2840 during business hours.

Submission Form

Everything you should know about boat insurance in Hong Kong

Last month, a yacht moored at Kwun Tong Typhoon Shelter caught fire and subsequently spread to the two adjacent boats. The smoke billowing out of the fire was so dense, that it could be seen from across the harbour. Witnesses said they heard multiple explosions. Two boats subsequently sunk into the sea, with the remaining one sunk halfway.

In Hong Kong, not many people can afford luxury yachts, so boat insurance is not always talked about. However, every luxury boat costs at least millions of dollars so it pays for boat owners to secure boat insurance to safeguard themselves against potential accidents. In today’s Kwiksure article, we will take a look at the main types and benefits of boat insurance.

What does boat insurance cover?

Boat insurance covers any damage, loss, and legal liabilities of your boat caused by accidents, including the following three types:

Compulsory third-party risks insurance

Mandatory for all boat owners in Hong Kong, this type of insurance only covers the liability for death or bodily injury to third parties, with the minimum compensation of HK$5,000,000.

Third-party liability insurance

This type of insurance only covers property and liability risks. The commonly used Institute Yacht Clauses includes the following benefits:

Coverage of specific perils such as perils of the sea, fire, lightning, and explosion.

Exclusions include:

(i) Outboard motors dropping off or falling overboard.

(ii) Personal effects.

(iii) Consumable stores, fishing gear and moorings.

(iv) Ship’s boat not permanently marked with the parent vessel’s name.

Hull and machinery insurance

As its name suggests, this type of insurance covers breakdowns and accidents of the yacht’s hull and machinery.

When purchasing boat insurance, it is important for you to specify which type of insurance you are after. If you just say ‘third-party insurance’, the insurer may purchase ‘compulsory third-party risks insurance’, which only covers the liability for death or bodily injury to third-parties.

Apart from the three types of insurance mentioned above, some insurers go the extra mile by offering extra coverages, such as:

Pleasure craft protection

It covers all financial loss due to theft, malicious damage, latent defect, repairer's negligence, third-party liability, fires, poor weather, lightning, or piracy.

Third-party protection

Damage to other properties or accidents caused to other people during the boat trip is also covered.

Property protection

It covers loss, damage or theft of specific contents, personal possessions or sporting equipment.

Post-accident protection

It covers relocation, salvage, search, vessel inspection, and motor cleaning expenses when the craft is damaged or in distress.

What may affect the premiums of boat insurance?

Size and volume of the boat.

The bigger the boat is, the more passengers it can carry, and the higher the premium will be.

Materials of the boat

The insurer will impose a higher premium for yachts made of wood. However, most yachts nowadays are made with glass fibre.

Engine power of the boat

Much like automobiles, boats with higher engine power can travel faster and face greater risks, and thus are charged with higher premiums. You can refer to the ownership/operating license for your engine’s type and power.

Use of the boat

If you’re not only cruising in Hong Kong waters, but also going to other places such as Macau, attending sea races, or lending the yacht to others (remember to declare it to the insurer beforehand), the premium will be more expensive.

Yacht club membership

Boat owners with a yacht club membership can moor their boats there, while others have to anchor their boats in public typhoon shelters. On a typhoon day, the shelter may get full and the boat owner may have to risk anchoring their boats elsewhere.

Boat owner’s history

The boat owner’s experience in sailing a boat, and whether his boat has been involved in an accident in recent years will also affect the premium.

What else should you notice when securing boat insurance?

If the Observatory has hoisted or expects to hoist the typhoon signal no. 3, depending on the insurance policy, some boat owners may be required to moor their boats at the typhoon shelter within a specific time period as stated in the terms, otherwise their claims may be rejected.

Besides, new boat owners will usually hire a full-time employee to sail or take care of the boat. Under this circumstance, the owner must purchase an employee compensation insurance for his staff.

Contact Kwiksure to compare insurance policies

Kwiksure is a leading motor insurance brokerage that specializes in motor insurance, motorbike insurance (both third-party insurance and comprehensive insurance), travel insurance, and home insurance.

Our feature articles such as [Saving Tips for Car Owners] Guide to running a car in Hong Kong 2020 and How to buy insurance for your second-hand car offer comprehensive motor insurance information to drivers. Contact us today for a free quote!

Recent Posts

- Are Electric Vehicles Really Environmentally Friendly?

- Adoption of Hydrogen-Powered Cars in Hong Kong and a Look at 4 Models

- 7 Things to Know about Electric Car Maintenance

- Performance and Prices of Latest Lexus Models in Hong Kong

- Performance and Prices of Latest Honda Models in Hong Kong

Navigating through the risks of your journey

“one of our best skills is listening.”.

We are here to understand your needs and specific requirements, so we can analyze your risk exposure and help you navigate the myriads of insurance choices to unearth those best suited to protect your yacht, yourself as a yacht owner, as well as your crew.

From securing suitable insurance from the right insurer to helping you navigate a complicated claim, we mobilize on our wide network of specialists, ranging from insurance surveyors to shipyards, to deliver a complete solution to your marine needs.

Our Yacht insurance program can be specially designed to cover the followings:

Yacht Hull

Yacht Cargo

Third Party Liability

Charter Risk

Protection & Indemnity

Management Team

- Major Service

- Legal Consultants

- Case Studies

- Cargo Information

- Local Information

- 2022 P&I Review

- 2021 P&I Review

- 2020 P&I Review

- 2018 P&I Review

- 2017 P&I Review

- 2016 P&I Review

- 2015 P&I Review

- 2014 P&I Review

- 2013 P&I Review

- 2012 P&I Review

- 2011 P&I Review

- Standard Wording Form

- P&I Rules

- Hull Clauses

- Hong Kong Headquarters

- Shanghai Office

- Dalian Office

- Singapore Office

- Zhoushan Office

Client Login

- Remember my password

- Forgotten Password

- Forgot your username?

ANDREW LIU & CO., LTD (ALCO) was established in Hong Kong in 1988 as one of the first marine insurance consultants assisting shipowners and charterers in China with their insurance and claims requirements. ALCO were the first insurance broker in Hong Kong to acquire the ISO 9002 certification with the goal to provide the best service.

ALCO is a member of the Hong Kong Confederation of Insurance Brokers (CIB), whilst its holding company obtained the listing status at OTCBB market of the United States in 1999. With offices located in Hong Kong, Singapore, Shanghai, Dalian, Fuzhou and Zhoushan today, ALCO is now operating as one of the major insurance broker specializing in Marine Hull, Protection & Indemnity, Charterers Liability and Cargo insurance in Asia. Aside from the traditional broking services, ALCO has a specialised Claims and legal Team, which is working 24 x 7 to serve its clients and vessels around the world. Over the years, ALCO has assisted in handling complex marine claims, handled arbitrations cases not supported by FDD insurers and desires to provide innovative legal solutions. What ALCO's insurance clients require and how ALCO can meet their needs is a goal which is constantly pursued by the company’s management. ALCO's philosophy is always to place themselves in the position of the client, so that whole team proactively thinks and cares for the client.

MISSION STATEMENT

ALWAYS PLACE YOURSELF IN THE POSITION OF THE CLIENT.

WHAT MORE CAN WE DO AT ALL TIMES FOR THE CLIENT SO THAT HE/SHE HAS A GRATIFYING EXPERIENCE AND HIS/HER EXPETATION IS EXCEEDED.

| CEO and Director | Mr. Andrew Liu |

| Vice President and Director | Mr. John Liu |

| Manager of Claims Department | Mr. Richard Cheng |

| FDD Director | Mr. Vivek Jain |

| Manager of Operations Department | Ms. Betty Cheung |

| Dalian Office Representative | Mr. David Wang |

| CFO and Group Financial Controller | Mr. Colman Au |

| Finance Manager | Ms. Jean Fong |

Major insurance we are providing

We provide various marine insurance arrangement, with impressed service.

- HULL & MACHINERY

- PROTECTION & INDEMNITY

- CHARTERER’S LIABILITY

- K&R AND PIRACY LOSS OF HIRE INSURANCES

- FREIGHT DEFENCE AND DEMURRAGE

- Loss of Hire

- Cargo Insurance

- Professional Indemnity

- Shipowners' Liability Cover

- Increased Value Insurance

- Innocent Owners Interest Insurance

Legal consultants

We provide legal advice on commercial disputes such as charterparty disputes and encourage our clients to seek our advice before the matter turns out to be a dispute or claim. In the event the dispute proceeds to arbitration in jurisdictions subject to English law, we can act for our clients to handle the legal proceedings. Our approach is to treat our clients’ claims as our own problems or claims and achieve the best cost effective solution to disputes.

We would briefly highlight some real cases where we have assisted shipowners.

- Personal Accident Insurance

- Club Unwilling to Put Up Security

- A Cargo Claim

- Advising a Shipowner on Hull Insurance Conditions

- Total Loss Claim

- A Case of Smuggling

- Claims Rejected by the Clubs

- P&I Cover Prejudiced

- Marine Arbitration

Copyright © 2012 Andrew Liu & Co LTD. All Rights Reserved. Website Design : Infinity

Our marine insurance brokerage services are provided by COSCO SHIPPING (Hong Kong) Insurance Brokers Ltd. in Hong Kong and COSCO Shenzhen Insurance Brokers Limited in Mainland China (collectively named as “COSCO Insurance Brokers”). Established in 1995, COSCO SHIPPING (Hong Kong) Insurance Brokers, a member of the Hong Kong Confederation of Insurance Brokers, received approval by the Insurance Authority to provide insurance intermediary service for general insurance businesses in Hong Kong.

In 2005, COSCO Shenzhen Insurance Brokers Limited (“COSCO SZ Insurance Brokers”) was set up and incorporated in Mainland China. COSCO SZ Insurance Brokers specializes in providing insurance brokerage services for vessels registered in Mainland China as well as to serve mainland China clients. This generates complementary advantages to both Hong Kong and Shenzhen offices by resource sharing and to provide high quality services to our clients.

Ship insurance refers to the insurer of marine insurance for insurance under the liability of the various types of ships covered by ship insurance and its related interests, responsibilities, and insurance liability. The insured person may insure the insurer of the risks that may be encountered in respect of the ship, the goods and other sea objects through the ship insurance broker.

COSCO Insurance Brokers are engaged in the provision of insurance intermediary services for the insured, i.e. ship owners, including designing insurance plans and polices, placing insurance coverage and loss prevention, and providing case settlement, claims, risk assessment and analysis, etc.

To cater for the clients’ needs, we provide more thorough, privileged and diversified products and solutions, including marine insurance and non-marine insurance, groups or individuals, etc.

- Hull & Machinery Insurance

- Disbursements Insurance

- War Risks Insurance

- Kidnap & Ransom Insurance

- Protection & Indemnity Insurance

- Time Charterer’s Liability Insurance

- Property & Liability insurance

- Ship Repairers Liability

- Shipping agents liability

- Professional Indemnity

- Directors and officer

- Credit Insurance

- Group hospital & accident

- Group Life Insurance

- Employee’s compensation

After more then 20-year unremitting efforts, COSCO SHIPPING Insurance Brokers gathers lots of talents and accumulated a wealth of professional knowledge and work experience. With years of credibility and efforts, we have gained our clients’ support and established good relationship with global major insurance companies.

- Our service team includes former ship owners, former ship captains, former average adjusters, former insurer, member of the Chartered Institute of Insurance (CII) and graduates from Maritime University.

- We provide insurance business for more than 550 ships, which may be Hong Kong’s largest ship insurance scale. In view of this huge business, we are able to secure competitive insurance conditions for our clients to global insurers.

- We are the first broker to introduce disbursement insurance into China’s ship insurance market and will continue to keep pace with it in the future.

- We have a good relationship with the Lloyd’s by securing insure war risk of more than 600 ships at Lloyd’s, which can get preferential rates and excellent service

COSCO SHIPPING Insurance Brokers pursues its sincerity, ambitious and innovative spirit. We will improve our service standard to create value for our clients, and maintain our leading position in marine insurance brokerage industry.

Rm 4701, 47/F, COSCO Tower, 183 Queen's Road Central, Hong Kong Tel: (852) 2809 6680 Fax: (852) 2547 2180 Email: [email protected]

Rm 1901, 19/F., East Tower, Hai An Mansion, Hai De Third Street, Nanshan District, Shenzhen, PRC Tel: (86) 755 8329 9385 Fax: (86) 755 8329 9160 Email: [email protected]

- [ September 6, 2024 ] DNV updates Emissions Connect to ease FuelEU maritime challenges Marine Services & Supplies

- [ September 6, 2024 ] STL arrives in Athens as part of European tour to promote HK maritime Government

- [ September 4, 2024 ] Air freight capitalising on marine’s tight capacity restrictions Logistics

- [ September 4, 2024 ] STL raises the flag for Hong Kong’s IMC at SMM Hamburg 2024 Government

- [ September 4, 2024 ] Hong Kong flagged bulk carrier arrived in India with stowaways Shipping

- [ September 2, 2024 ] DP World enters retail and fashion logistics through Hong Kong entity Logistics

- [ September 2, 2024 ] Panamax market provided further losses last week and shows little sign of abating Shipping

- [ September 2, 2024 ] Tide reverts for LNG as containership fuel General

Overview of Hong Kong marine insurance

- Ship’s hull and ship’s liability

- Yacht hull and liability

- Marine cargo

- Charterer’s insurance

- Bareboat charters

- Vessels under construction

- Mortgagees’ insurance

- Mortgagees’ interest insurance (MII) Mortgagee additional perils (MAP) Mortgagee’s financial loss

- Kidnap and ransom (vessels and ship’s crew)

- Carrier’s liability

- Ship’s crew personal accident cover

In 2014, Hong Kong’s marine insurers made a collective underwriting profit of HK$50.1m, from gross premiums of HK$2.36bn. During the same period net claims paid amounted to HK$941.7m and net claims incurred stood at HK1.079bn.

For contact details and background please go to the Directory page of this website.

Copyright © 2024 | Hong Kong Maritime Hub | Website by Precision Printing and Publishing Services

- Construction & Engineering

- Energy & Power

- Financial Institutions

- Health & Care

- Manufacturing

- Motor Fleet

- Professional Services

- Real Estate

- Construction All Risk

Credit & Capital

- Cyber & Tech

- Fidelity & Money

- Jewellers block

- Kidnap & Ransom

- Mergers & Acquisitions

- Product Recall

- Professional Indemnity

- Surety Bonds & Guarantees

- Trade Credit

Employee Benefits

- Employee Benefits Consulting

- Group Medical Insurance

- Group Travel insurance

- Employees' Compensation insurance

Private Clients

- Private Clients overview

- Home & Contents Insurance

- Life & Private Medical Cover

- Motor Insurance

- Travel Insurance

- Yacht & Pleasure Craft Insurance

- Performance Bonds

- Political Risks

- Management Liability

General Liability insurance

- Product Liability

- Asia Pacific

- The Americas

- Middle East & Africa

Don't see a country you're looking for?

Together with our partner brokers, we are part of a global network so whether you’re a multinational looking for a broker that’s truly global, or a smaller business looking to insure your local needs, we can help you.

Marine insurance

High-value assets consistently in volatile environments will always present major risk challenges. that's why marine risk scenarios can be incredibly complex. talking to specialist marine risk consultants gives you the confidence to be bold, innovative and responsive to change in the business environment. .

Our philosophy is simple. We are here to serve you, and that means powering your ambitions.

Howden brokers take the time to get to know individual businesses, vessels, and fleets; taking a hands-on personal approach means we can arrange quality cover at a cost-effective price.

If you’re building, owning, consulting or operating at sea, you need an insurance partner with an in-depth understanding of the issues you face, to help you streamline and save.

Howden Highlights

Quality cover at a cost-effective price

We believe that our role is more than just protecting our clients from risk. As your risk consultants, we exist to empower you to grow your business by removing risk obstacles - the emphasis is always on the quality of cover, ready to stand strong when you need it most.

Broad global market access

The Howden Specialty Team has the market knowledge, relationships and broking expertise to cover any marine risk, regardless of size or complexity.

Global programmes

Streamlining your insurance into one global policy can save time, effort and money. Eliminate gaps and contention between contracts and providers by having one clear global view of your risk.

Skilfully designing insurance wordings

Responsive insurance that helps when you need it most takes careful planning and attention to detail. This is where we excel, keeping all wordings firmly in your favour.

We work with companies ranging from global energy companies to independent contractors.

We create bespoke solutions for:

- Upstream Supply Vessels & Workboats

- Port Authorities & Terminals

- Ocean Going Vessel Operations

- Inland River Tug & Barge Operations

- Dredging / Wet Construction Companies

- Commercial Fishing Operations

- Vessel & Upstream Structure Shipyard Construction

- Commercial and Sport Diving

Contractors we support:

- Oilfield Services

- Subsea Services

- Upstream Drilling

- Liftboat Operators

- Diving Operations

Speak to a marine insurance specialist

Let's talk...

+852 2877 2238

We'll put you in touch with the person best equipped to help.

Call us on +852 2877 2238 or drop us a quick message and we'll get back to you asap

Visit us at: 35/F Citicorp Centre, 18 Whitfield Road, Causeway Bay, Hong Kong

Privacy policy

The Howden Specialty Team has a core expertise encompassing the following:

Hull & marine liabilities for all types of tonnage and exposures.

- Hull and machinery

- Disbursements (increased value, freight etc.)

- Loss of hire

- Charterers’ liability

- Charterers’ default

- Machinery deductible

- Protection and indemnity

- Towage risks

Ports & Terminals a broad range of risks whether liability or physical loss

- Loss of, or damage to, cargo under your care, custody or control

- Third-party liability

- Professional indemnity

- Fines and penalties

- Physical loss of, or damage to, equipment

- Port property

- Business interruption

Mortgagee interests, financial institutions, ship mortgage insurance and financing insurance

- Mortgagees’ interest

- Innocent owners’ insurance

- Lessors’ interest insurance

- Political risks insurance

- Shipyard & Related Risks

- Shipyard and building risks

- Construction liability

- Ship repairers’ liability

- Worldwide delay in delivery

War, Kidnap & Ransom and Political Risks

- Kidnap and ransom

- Confiscation, expropriation and nationalisation

- Credit insurance

Find out about our Marine Cargo Insurance

Marine businesses need.

Cyber insurance

Safeguard your business against digital threats

Cost effective packages and talent strategy support

Classic slips and trips insurance for everyday business risks

Heavy Equipment insurance

Heavy equipment comes with a heavy price tag. Don't bear the burden alone

Industrial and Commercial property insurance

Industrial and commercial property insurance

Marine cargo insurance

Simplify, streamline and save with a global programme

Surety and Counter Bank Guarantee insurance

Take the risk out of your business dealings

Can't find what you're looking for?

- English

- Español

- Romanian

- Slovak

- Slovenian

- Serbian

- Russian

- Swedish

- Greek

- Bulgarian

- Japanese

- Thai

- Turkish

- Czech

- Ukrainian

- Portuguese

- Korean

- Polish

- Arabian

- French

- Deutsch

- Italiano

- Hebrew

- Malay

- Indonesian

- Danish

- Croatian

- Finnish

- Hungarian

- Dutch

- Norwegian

- Chinese Simplified

- International

- Delaware

- Poland

- Spain

- Italy

- France

- Greece

- Portugal

- Netherlands

- United Kingdom

- Jersey

- Cayman

- Cyprus

- Panama

- Marshall Islands

- British Virgin Islands

- Cook Islands

- Gibraltar

- Langkawi

- Belgium

- Malta

- Tuvalu

- Seychelles

- Albania

- Andorra

- Argentina

- Australia

- Bahamas

- Bahrain

- Barbados

- Belize

- Bolivia

- Brazil

- Bulgaria

- Canada

- Chile

- Colombia

- Costa Rica

- Croatia

- Denmark

- Dominica

- Dominican Republic

- Ecuador

- El Salvador

- Estonia

- Fiji

- Finland

- French Guiana

- French Polynesia

- Germany

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guyana

- Honduras

- Hong Kong

- Iceland

- Ireland

- Kuwait

- Latvia

- Lithuania

- Malaysia

- Martinique

- Mexico

- Montenegro

- New Zealand

- Nicaragua

- Norway

- Oman

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Puerto Rico

- Qatar

- Reunion Island

- Romania

- Russia

- Saint Lucia

- Samoa

- Saudi Arabia

- Serbia

- Singapore

- Slovenia

- Solomon Islands

- South Africa

- St Kitts

- St Maarten

- St Thomas

- Suriname

- Sweden

- Tonga

- Trinidad

- Turkey

- United Arab Emirates

- United States

- Uruguay

- Vanuatu

- Venezuela

- St Vincent

- Ukraine

- Liberia

- Guernsey

- Isle of Wight

- Delaware

- Poland

- Cayman Islands

- France

- Dealers Wanted

Hong Kong Marine Insurance - Boat & Yacht Insurance Hong Kong

Do you want to save about 40% on boat insurance in hong kong, register your hong kong boat insurance in 3 easy steps.

Why choose us for your boat Insurance?

- We work with insurance companies that cover ALL WATERS, ANYWHERE IN THE WORLD

- The rates we can find you are on average 40% less then our clients current rates

- We can find you insurance for all types of vessels including power & sail boats, house boats, jet skis, pontoons, etc

- Our paperwork is minimal; just some questions about the type of boat you have and were you will be using it

- Fill in our no obligation quote. You will not receive any calls from us. Just decide on the quote and if you are not interested we will not hear from you!

We offer marine insurance in Hong Kong for all type of vessels

Types of Boat Insurance

Boat insurance policies typically offer three primary types of coverage

1. Liability Coverage:

2. collision coverage:.

Collision coverage is a vital safeguard for your boat following an accident. It empowers your insurance provider to shoulder the cost of repairing your vessel. Some insurance companies treat collision coverage as a distinct component of their policies, while others incorporate it within comprehensive boat insurance plans. Regardless, the coverage amount depends on your boat's declared value as specified in your policy. Boat insurance collision coverage offers protection against a range of accidents, whether you're at fault or not. This includes collisions with other boats, collisions with underwater obstacles or rocks, or damage to someone else's property.

3. Comprehensive Coverage:

Comprehensive boat insurance offers extensive protection for your vessel beyond collision scenarios. It covers risks such as theft, vandalism, and fire damage. Additionally, it typically provides coverage for potential damage from natural disasters like hurricanes, floods, and hail. However, the specific extent of protection against these hazards can vary among insurance carriers. Comprehensive coverage is often bundled with collision coverage, making it uncommon to obtain one without the other. This combined coverage ensures comprehensive protection for your boat, whether it's in use or not.

Frequently asked questions (FAQ) about Marine Insurance

No, it does not matter where you have chosen to register your boat. Our clients have their boats registered in many different countries including; Poland, Langkawi, BVI, Delaware, Panama, Cayman Islands, Spain, Portugal, France, Italy etc.

No, our insurance partners offer coverage for all areas around the world. Just make sure to indicate on the quote request form the area where you will be using your boat to include it in your policy.

- Ext. 3rd-Party Insurance for Skippers

- Professional Skipper Liability Insurance

- Deposit Insurance for Chartered Yachts

- Travel Cancellation Expenses Insurance

- Charter Price Contingency Insurance

- Skipper & Crew insurance packages

- SeaHelp CharterPass

- Travel Health Insurance

Get a no obligation quote for Hong Kong boat insurance?

Fill in our online quote request in 5 minutes

« Fast and easy process, very cheap quote. »

© Copyright Hong Kong Boat Insurance • 2024 Part of EC Global Promotions LTD.

• SUBSCRIBE •MAGZTER •NEWSLETTER

•CONTAC T US

Asia's leading yachting lifestyle media

More results...

Tommy Ho: The Rising Son of Yacht Insurance in Asia

- August 7, 2019

Yacht Style profiles TOMMY HO, Founder and CEO of Voyager Risk Solutions, who manages insurance for many of Hong Kong’s new luxury yachts and is starting to expand across Asia.

Tommy Ho Wai-lok is well known in Hong Kong’s yachting circles, but plenty still know him as the third son of Ho Sai-lo, who retired in June 2018 after 35 years managing the boat yard at Club Marina Cove.

Tommy Ho with Kara Yeung, Executive Director of HKCYIA, at the signing ceremony of the MOU for Hong Kong’s new Superyacht Management Services Centre

Tommy still frequently attends events at Marina Cove as the Sai Kung venue regularly hosts private events for many of the world’s leading luxury yacht brands, including Ferretti Group, Azimut, Sunseeker, Fairline, Monte Carlo Yachts and Prestige from April through June.

In June, Voyager co-hosted the Family Days weekend at the end of the nine-day Ferretti Group Itinerary Show and Tommy found himself fielding more questions about his father than himself.

“When I go to Marina Cove, lots of friends and familiar faces come up to me, but they all ask about my Dad, like how’s Sai-lo enjoying retirement, how’s his health,” laughs Tommy during an interview with his father and mother, Susie Lei, who’s still involved with the family’s yacht repair business at Royal Hong Kong Yacht Club.

“When I go to events, a lot of people know me because of my parents and in fact, we generated business at that event. It’s great I’m also in boating like my parents, because we can always talk about boats, whether one’s good or bad, its design, the quality, so on.”

However, what’s surprising is how often Tommy’s surprised when hearing stories from his parents, who both grew up working on the water, his father initially crewing on sailing boats and his mother a leader of one of the famous ‘side party’ groups of sampan women who cleaned the hulls of military ships.

AROUND THE WORLD

In the early 1960s, Ho senior responded to an advert from an American, Vad Jelton, who was recruiting two crew for a long cruise with his wife on a 55ft sailing yacht.

Susie Lei and Ho Sai-lo with Tommy Ho, their third son

Sai-lo recalls: “I saw the advert recruiting for crew, so I went for an interview. At that time, my salary was HK$160 per month…”

Tommy’s eyes widen in shock – “Wah, so little” – before his father continues.

“Then the American offered me HK$700 per month, so it was an easy decision. The boat stopped in a lot of places so it took a long time, almost two years. We eventually finished working in San Francisco.”

“He did it for the money,” smirks Susie, who married Sai-lo after he returned to Hong Kong in late 1965.

Sai-lo said the most alarming episode was when the owner’s wife started screaming as she thought the boat was going to sink.

“The wife was steering, but she was hungry, so she asked me to take over at the wheel while she went to get some food. When she got down to the galley, she found the whole place was flooded and started crying out. A hole in the pump was leaking and flooded the whole deck. We stopped the boat, found out where the leak was, then repaired it.”

Tommy Ho’s mother, Susie Lei (on left), with Prime Minister Edward Heath at the 1971 London Boat Show, with the photo appearing in the South China Morning Post

As Sai-lo continued to work as crew on boats on his return to Hong Kong, Susie continued her sampan-based work, which included managing her side party brigade, cleaning the sides of Royal Navy ships at HMS Tamar, chipping off rust and repainting them.

“They didn’t pay me,” she says. “They’d give us old rope, wires, anything we could either use or sell.”

Tommy knows about his mother’s participation in the 1971 London International Boat Show at Earl’s Court when ‘The boats and water-people of Hong Kong’ was a theme and she was one of two ladies, along with Annie Ho, selected to represent the then-colony.

“They wanted to promote Hong Kong and they sent two sampans to London for the show. I had been working with the Royal Navy ships for a long time, since I was very young, and they chose two of us. Rowing a sampan is quite a skill because there’s only one paddle to power and steer,” Susie says.

“I flew there on December 31, 1970, but arrived on New Year’s Day in 1971. It was the coldest place I’d been. Then, for the opening ceremony, I rowed the sampan for the British Prime Minister, [Edward] Heath.”

Tommy is again in shock, his head flicking back, eyes wide open. “I didn’t know that!”

“A lot of people came up to me for autographs,” Susie continues. “What for? I didn’t understand what they wanted.”

BACK IN HONG KONG

In the early 1970s, Sai-lo became a foreman at the Royal Hong Kong Yacht Club before setting up his own family-named repair service operation onsite in 1977 with Susie, who has helped manage the operation for over four decades, although she has recently handed most responsibility to Tommy’s second-eldest brother.

Tommy Ho (middle) with his brothers on the family boat in Causeway Bay Typhoon Shelter

In 1983, Sai-lo left the new family business to join the new Club Marina Cove, which Henderson Land had developed from a fishing farm into a marina and residences. In fact, Sai-lo was recruited by Grantham Sharkey, Tommy’s godfather and the former marina manager of Royal Hong Kong Yacht Club, who was hired by Marina Cove.

When Tommy was young, the family spent time living on a junk in the Causeway Bay Typhoon Shelter by Royal Hong Kong Yacht Club and he has fond memories of this period of his life ( featured in COLUMN, Issue 46 ), although there were hardships, such as showering with no hot water.

As a schoolboy, Tommy joined his father at Marina Cove each Sunday, helping yacht owners with their belongings, cleaning yachts and doing other odd jobs.

“I needed to make some pocket money,” says Tommy, who has a younger sister as well as two elder brothers. “I remember owners in those days were very generous. A Coca-Cola was HK$2 and the owners would give me HK$20 tips.”

After finishing his studies, Tommy worked for the local dealer of Musto sailing apparel and also distributed other sailing gear and even jetskis, selling over 100 in a year. However, when the effects of the 1997 Asian financial crisis took effect, he had to close his shop and found himself in debt.

Tommy Ho in the background at June’s Family Days weekend at Marina Cove, co-organised by Ferretti Group and Voyager

Tommy started working at the Royal Hong Kong Yacht Club, where he met Colin Dawson, who thought the youngster’s extensive experience in boating would prove an asset in insurance, so asked him to join him at Heath Lambert.

Tommy’s first day in insurance was September 10, 2001, a day ahead of the infamous 9/11 attacks. Despite the inauspicious start, he worked at Heath Lambert until 2006 and then spent 12 years at Aon until founding Voyager last year.

THE VOYAGE CONTINUES

With strong financial backing and Tommy’s now 18 years in the industry, Voyager has made strong inroads into the local yacht insurance market in a short time. “I’d say 80 per cent of the boat dealers in Hong Kong are using our services,” he says.

Recent high-profile contracts include those for the first-ever Pershing 140, which could arrive in Hong Kong in September, and Ferretti Group models from Riva, Custom Line and Ferretti Yachts. Others include an Azimut Grande 32 Metri and Sunseekers like the 74 Predator set to arrive in July and 76 Yacht that arrived earlier this year.

Voyager is managing the insurance for the first-ever Pershing 140, coming to Hong Kong

Voyager has also signed an MOU with the Hong Kong Cruise and Yacht Industry Association (HKCYIA) to provide risk-management and insurance consultation services for the upcoming Superyacht Management Services Centre, which is a redevelopment of the Yiu Lian and Euroasia Dockyards in Tsing Yi, and set to open in 2020.

Along with his team’s insurance expertise, Tommy is confident of Voyager’s well-rounded offerings due to his and his family’s vast experience of working on yachts and with the many key suppliers, yacht clubs and marinas in the city.

“This is where we show our expertise. I know whether any repair claim is reasonable or if a supplier is overcharging. I can also call shipyards to prioritise urgent repairs. I’ve even helped prevent yachts from sinking by making phone calls to the right people,” he says.

“I’m also a boat owner, so I know what owners need to look out for and how they think. There’s no other insurance broker with my connections in Hong Kong, plus I also have a good network in China, Taiwan, Philippines and so on.”

In fact, one of Tommy’s next ambitions is to expand Voyager across Asia and the move has already begun with a representative office in Singapore. He’s looking for opportunities to expand in the likes of Taiwan, Philippines and Thailand.

Tommy Ho’s famliarity with so many aspects of the yachting industry is due in large to his parents

Yachting makes up the vast majority of Voyager’s business, so his other ambition is to expand business in non-yachting sectors, which already includes automobiles, art, wine, jewellery, financial, even kidnapping and ransom, and now professional indemnity insurance.

“We know everyone in yachting in Hong Kong, so we can improve here, but not by a great amount. However, we definitely can increase a lot in the other sectors in the coming years.”

Tommy remains upbeat about his city’s own yachting market, which has slowed due to a lack of berths. He believes there’s potential money and interest in growing infrastructure in the city, but that government approval remains an obstacle.

“For one, Discovery Bay is being redeveloped, while I’ve been speaking to some tycoons and they’re interested in investing in and building marinas. They’re even asking where they can buy land for this, but building a marina needs approval from many different government departments.”

Tommy Ho may be among the most connected people in Hong Kong boating circles, but he’s well aware of who gave him the start in the industry and provided him with the network and support to be one of the region’s rising stars in yacht insurance.

“Tycoons won’t do business with you unless they know you, who you are, like some family history or connections.” And for that, he knows who to thank.

The original article appears in Yacht Style Issue 48. Email [email protected] for print subscription enquiries or subscribe to the Magzter version at: w ww.magzter.com/SG/Lux-Inc-Media/Yacht-Style/Fashion/

Yacht Style 48: The 2019 Charter Issue Out Now! Yacht Style 48: The 2019 Charter Issue Out Now! SHARE Share on facebook Share on linkedin Yacht Style's annual Charter Issue covers Asia's greatest getaways, the 2019-20 racing calendar, and yachts...

Editor's Picks

Editor's picks.

Luxury Mediterranean properties to invest in

Niche Perfumery Insights From Johanna Monange, Founder Of Maison 21G

L’ARÔME BY THE SEA Welcomes New Executive Chef

Cartier’s Santos de Cartier Dual Time: The First Multi-Time Zone Marvel

Restructures, revamps, milestones and more for Beneteau

Defying Wonder By Discovering The Garden Of Eden In The Galapagos Islands

Sylvie Ernoult explains the changes she’s steering for this year’s Cannes Yachting Festival

Gulf Craft Group appoints corporate veteran as new CEO

Japan courts superyacht cruising

Michelle Ye: Aquitalia’s ‘Goddess of Water’

Yacht insurance is money well spent

Italy sets yacht export record

Driving Electrification

Fraser Market Intelligence: What a difference a show makes

Subscribe To Our Newsletter

Copyright © 2024 Website by Malikhan Design & Digital

All Rights Reserved © 2023

Copyright © 2024 Yacht Style.All Rights Reserved .Website by Unstoppable.

Discover more from Yacht Style

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

What can we help you find?

WTW is one of the oldest names in marine insurance having commenced as a marine broker in 1828. The Global Marine team continues to address the needs of the sector through innovative risk advice and global broking excellence.

The marine industry requires uniquely specialised solutions for its management of risk and we work in partnership with clients. The Global Marine integrated approach is backed by decades of knowledge allowing us to offer global expertise through point of contact at a local level, subject to local licensing requirements.

Knowledge and experience

Strategic understanding of your industry, evidenced by the deep experience within the team.

The power of innovation

We leverage our marine industry knowledge and client insight to drive innovation across our risk solutions.

Global capabilities

A global team of 550+ marine specialists supporting your opportunities across our marine centres of excellence.

Market strength

With coordinated access to the global marine insurance marketplace, we aim to provide cost effective risk solutions to support your needs.

Market analysis

Insightful market selection based on settlement performance, loss prevention and emergency response as well as financial security.

Beyond the marine transaction

As your risk adviser we have a connected approach to risk, providing guidance on all aspects of your operation, whilst optimising total cost of risk.

Supporting you at critical times

Clear, effective advice and support in the event of a major loss, provided by our claims advisory and in-house adjusters.

Creating partnerships

Working together to harness your position as the best advocate of the risk, early selection and choice of the most appropriate strategic insurance partners, irrespective of global location.

Our global colleagues work across several specialty teams:

- Shipping and Maritime Industries : Hull and Machinery (H&M), Protection and Indemnity (P&I), Special Risks (Marine liabilities)

- Global Cargo

- Specie : Fine Art, Jewellery, Cash Management

- Global Asset Protection : Superyachts, and Private Clients

Claims – supporting you at critical times

Effective claims management is the ultimate measure of your broker:.

- We understand the importance of delivering clear and effective advice.

- We are proud of the reputation of our in-house Marine claims specialists and average adjusters.

- Leveraging our global and local expertise, specialist teams can be on site supporting the claims process round the globe.

- We make claims based (not just price based) decisions when selecting insurance partners and understand the importance of measuring and managing the performance of insurers.

Related insights

An informative podcast series that brings you the latest perspective from the construction industry.

Trevor McGarry, Head of Cargo & Specie, GB, discusses the current market conditions for the Marine industry.

Global marine services

From shipyards, to ports and terminals, to all classes of vessels and marine exposures, WTW provides global risk consulting expertise across the maritime industry.

Our global team of over 200 specialists help clients manage the risks associated with cargo across multiple industry sectors.

Few things are as valuable as fine art, jewelry or specie (such as bullion or bank notes) and there are limited markets for insuring such risks. With the need for extremely high limits and operating flexibility, the importance of expertise in handling this type of exposure is clear.

With the exclusive aim of protecting your most precious and valued possessions, our Global Asset Protection team offers personalised risk advice and insurance solutions for your personal assets, including superyachts and property.

- Chubb in Hong Kong SAR & Macau SAR

- Corporate News

- General Insurance

- Life Insurance

- Media Resources

- Chubb Life's Awards and Accolades

- Financial Strength Ratings

- General enquiry form

- Chubb Life Insurance

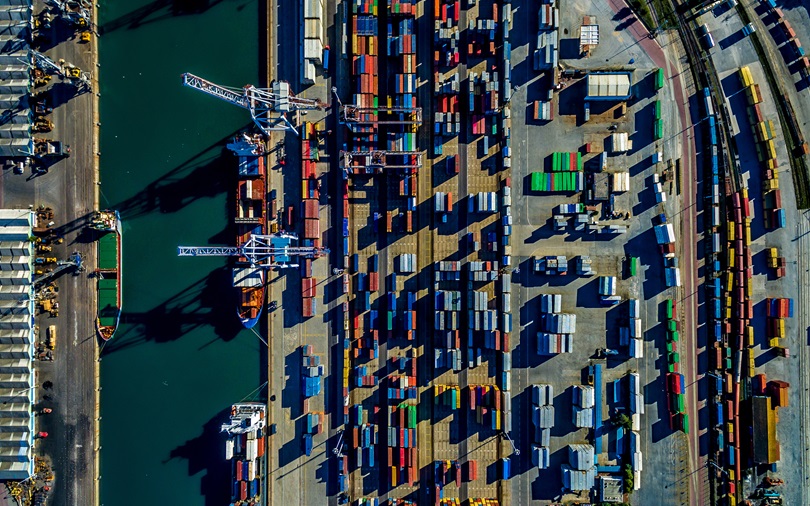

Cargo Insurance

Protect your cargo from ocean and inland risks

We create solutions for a variety of ocean and island marine risks and draws upon our experienced underwriters to create bespoke solutions for a wide variety of shipping needs.

Chubb’s Cargo product is supported by an in-house risk management team of:

- Specialist surveyors

- Loss control advisers

- Experienced claims adjusters

Areas of focus include:

- Single shipment cargo insurance

- Annual, open and short-term cargo insurance for domestic and international shipments

- Transport operators’ freight liability with cargo protection options

- Truck cargo insurance

- Fine art and valuable goods covers

Chubb can provide a high limit protection of up to US$25 million for conveyance, with additional capacity made available through other members of Chubb.

Chubb has a long term focus on clients relationships and can provide:

- Web-based system to quote and/ or issue cargo insurance

- A high limit protection of up to US$25 million for any one conveyance with additional capacity made available through other members of Chubb

- Chubb CargoAdvantage® system provides instant quote and certificate issuance

- Shipment insurance products for high volume and lower value deliveries

- Customised risk management solutions

- Established logistics and project cargo practice

- Experienced Marine Underwriters

- Ability to accommodate high policy limits

- Long-term focus on client relationships

- Tailored multinational programmes

- Wide commodity range

- Worldwide network of claims professionals

Get Additional Benefits With Cargo Plus

Chubb’s Cargo Plus SM is an enhanced cargo insurance policy with broad coverage for both international and domestic cargo movements. The major benefits include:

- Over 15 additional benefits for local cargo transportation

- Over 30 additional benefits for international cargo movements

The above information is intended to be a general summary for reference only and does not form part of the policy. You should refer to the policy wording for exact terms, conditions and exclusions. The above information shall not be construed as an offer to sell or solicitation to buy or provision of any of our products outside Hong Kong SAR. For further information, please contact Chubb Insurance Hong Kong Limited on +852 3191 6800.

Marine Insurance: Cargo Protection

Marine Cargo Insurance (Single Shipment)

Marine Cargo Insurance (Open Cover)

Related Products

Logistics Insurance

Marine Logistics Insurance for the Commercial sector from Chubb, customisable specialist cargo products to tackle industry risk exposures.

Project Cargo Insurance

Project Cargo Insurance for the Commercial sector from Chubb, specialist in cargo insurance products to protect against loss, damage and delays.

Fine Art & Valuable Goods (Specie) Insurance

More than 60 years’ experience of fine art and valuable goods experience with local expertise and worldwide resources.

Related Articles

Have a question or need more information.

Contact us to find out how we can help you get covered against potential risks

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Flexible and tailored marine insurance solutions

Featured article.

How brokers can use Loss Control to differentiate themselves

Learn more about the risks facing companies today and tomorrow in our KNOWLEDGE & INSIGHTS CENTRE .

Inland Marine

Marine cargo, marine liability, marine loss control engineering.

Welcome to Lloyd's in Hong Kong

Read more about diversity and inclusion at lloyd’s., our story in hong kong, supporting the hong kong insurance industry for over 50 years. .

Through Hong Kong coverholders and trusted London centred partnerships, Lloyd’s underwriters are amongst the largest commercial insurers and reinsurers in the territory. Our customers are the businesses and entrepreneurs who drive and serve the Hong Kong economy and they come to Lloyd’s to access the scale, diversity and financial strength of our specialist insurance and reinsurance market.

Lloyd’s provides tailored insurance and reinsurance solutions for a variety of Hong Kong risks including marine, aviation, accident and health, energy, commercial and personal property, and a wide variety of liability and financial risks.

The depth of expertise and breadth of products sets the Lloyd’s market apart. Customers have access to the combined scale, expertise and capacity of an entire market, not just a single insurance company.

As our world is reshaped by economic, environmental, geopolitical and technological shifts, the breadth, depth and responsiveness of the Lloyd’s market gives Hong Kong businesses the confidence to move forward in the face of uncertainty.

Our work in the community

Lloyd’s is committed to improving lives and building resilience in the local community. Through the Lloyd’s Together program we support local communities with projects that focus on education and employability, environment and sustainability, social welfare and health and disaster preparedness and relief.

In Hong Kong, Lloyd’s has hosted several Beach Clean Up events in the past few years. Together with our local partners, we have worked to remove huge amounts of rubbish from Hong Kong’s beaches, contributed to awareness of sustainability and recycling campaigns and sought to improve our local environment. In February 2023, Lloyd’s Hong Kong has hosted another Corporate Social Responsibility event with Ark Eden Foundation. Together with over 30 business partners we had one day of Ecological Restoration & Organic Farm Services, which involved fertilising, watering & measuring the growth of native tree saplings to help reduce Hong Kong’s deforestation rate.

The Lloyd’s market champions diversity and is leading the field in encouraging open, inclusive cultures across our industry.

Our solutions in Hong Kong