- Now Trending:

- Tim Taylor Takes us on a...

- Chartering in the BVI &#...

Nautical Monkey

Should i put my boat into an llc or corporation before partnering or sharing.

Both an LLC and a corporation provide personal liability protection, which is ostensibly the main goal of putting your boat into a corporate environment.

Both LLC’s and Subchapter S Corporations provide pass-through taxation – meaning you would report profits and losses on your personal tax returns.

However, since an LLC provides the same liability protection as a corporation and is much simpler to form and maintain, I find it is probably the better choice for this scenario.

Why would I want to put my boat into an LLC?

There are several reason you might want to transfer your boat into an LLC including liability protection, tax shelters and leveraging greater tax deductions.

Liability Protection

Transferring your boat into an LLC is useful because generally it is the LLC who would be responsible for liability associated with the boat. For example, if one of your partners or a guest was seriously injured or killed on the boat they wouldn’t be able to sue you directly.

Instead, they would sue the corporation that owns the boat and you and your personal assets would be protected from any judgments.

This protection is not absolute however. In some situations where the line is blurred between the “corporation” and the “individual,” courts can hold an individual personally liable which, in legalese, is referred to “piercing the corporate veil.”

These situations can be complex and the many issues associated with this part of law would be an article unto itself.

The bottom line is that the more blurry the line between a corporation and an individual the easier it is for someone to go after your personal assets if they win a judgment against a corporation you own.

For example, if there is only one shareholder/member/officer (the boat owner), no employees, no separate bank accounts, no income, no meetings – in short, if none of the things we normally see in a corporation exist, the corporation could be said to be a “sham” and a court could look beyond the “legal fiction” to the reality of the situation, i.e., you could be sued directly.

Putting your boat into an LLC can afford a measure of protection from liability but it is not an absolute protection.

Further, for any protection to exist at all you need to make sure you treat the company as a company – filing corporate documents and keeping up with corporate meetings, regularly recording expenses and income and doing a thorough business tax return.

Can the LLC act as a Tax Shelter?

The answer is sort of. The LLC can work as a tax shelter for a future buyer in states that have high sales tax which can be appealing to buyers when you try to sell your boat.

The basic idea is that if you buy a boat you pay sales tax on the transaction whereas if you buy a company that owns a boat you avoid sales tax.

This might be a consideration in the sale of a very large boat (i.e., saving the buyer a few thousand dollars of sales tax) but it does add complexity to the transaction (he would be buying a company not just a boat).

And buyers who may not be familiar with corporations may be leary of why this boat is in one.

In addition, some buyers would just purchase the boat from the company and you’d be left with a shell which you would still have to go through the process of dissolving.

Finally, unless the corporation is set up in a tax free state (like Delaware) you would still have to pay tax when you put the boat into the corporation.

So from a tax shelter standpoint, putting your boat into a corporation is a potential benefit only for a future buyer who may not even choose to use the benefit you’ve worked so hard to create.

Day to day tax implications

From a day to day tax standpoint, there may be some other advantages to putting your boat into an LLC such as leveraging accelerated depreciation schedules, taking losses for cleaning, maintenance, repairs, utilities, etc. However, there is a trade-off.

A thorough and accurate tax return for a business that takes advantage of all the available tax breaks can be costly.

And, unless you accurately and systematically record costs and income using a good accounting package such as Quickbooks, it can be difficult to leverage enough of a tax benefit to justify the cost and effort associated with the formation and maintenance of the LLC.

What are the Insurance implications of putting my boat into an LLC?

Based on the research we have done, there is not a lot of difference in premiums when insuring a privately held boat versus insuring one held by an LLC.

The main thing to understand is that if you decide to go the LLC route, the insurance will need to be in the LLC’s name not yours. Have a look at our Insuring your boat in a Partnership blog for more information on insurance.

How do I get my boat into an LLC or corporation?

Putting your boat into an LLC is basically the same as selling it to another person and has all the same implications. In terms of title transfer, you would just need to register the boat in the LLC’s name. As usual however, there are several things to consider before taking this action.

First , if you have a note on the boat, the transfer of title from your name to the LLC may engage an acceleration clause.

That is, most notes are going to have some standard language indicating that if any or all the interest in the asset/boat is transferred without the lenders prior written consent, the lender has the right to require immediate payment of the entire note balance.

In most cases, the lender has no incentive to provide consent for the transfer into an LLC because it would limit their recourse if you stopped paying – i.e. it would make it more difficult to go after you directly.

Second , just like a sale between you and another person, there is a possible tax implication in the transfer to the LLC even though you are the sole owner of the LLC because the LLC is a separate legal entity from you.

This will depend on a myriad of different factors and is a good reason to have an accountant help with the transaction.

Third , if you do have a note on the boat you are transferring into the LLC, your personal guarantee of the note can have the effect of weakening the wall between you and your company from a liability perspective as we talked about above.

There is no way to directly calculate this risk but it is something to take into consideration if you are able to transfer the boat into the LLC while still holding the note personally.

Fourth , you could complete an actual sale of the boat to the LLC by getting a loan under the LLC which would then be used to pay off your personal loan.

The issue here is that a corporate loan is going to have a higher interest rate (sometimes substantially higher) and it is often very difficult to get a loan for a brand new company that has no income, business model, employees, or other assets.

Using an umbrella policy in addition to or rather than forming an LLC

While an LLC is one possibility, if you only have one watercraft and are not planning on running a charter or rental business you can cover most of your risk by using a good partnership agreement and putting an umbrella policy in place.

The partnership agreement will define the responsibilities and expectations as well as liability of the partners and if something does go wrong outside of anything contemplated by the agreement, the umbrella policy can cover most of your liability.

It should be noted that you will need to have adequate insurance on the boat in addition to the umbrella policy for it to be effective.

In other words, you can’t just get an umbrella policy to insure an otherwise under insured asset. Both your boat and your other assets need to be in good shape from an insurance coverage point of view for this to work.

So…, should I put my boat into an LLC or Corporation before partnering or sharing?

As you can see there are many issues to consider before heading down this path. For the LLC to effectively protect your personal assets you need to take the time and expense of making the ongoing commitment of maintaining a company – filing all the right paperwork, recording expenses and income, doing your corporate taxes, etc.

Notwithstanding your decision to put the boat into an LLC, you will need to have a good strong partner agreement and should probably have an umbrella policy in place.

You can purchase a $1,000,000 umbrella policy for around $200 per year so there is little reason not to have this additional protection.

Hopefully this article has given you a good handle on the complex issues related to this subject and provided some direction should you go down this path.

As always, you are strongly encouraged to seek the advice of a lawyer and an accountant if you proceed and please don’t hesitate to contact us if you have any questions about this article.

Related Posts

Read some interesting information from John Davis one of the authors at Nautical Monkey.

Outstanding article

These are very good questions, which should be considered by all, since it is your private property.

Your email address will not be published. Required fields are marked *

Email Address: *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Nautical Monkey Main Site

Benefits of Holding Commercial and Recreational Vessels in Limited Liability Companies

Apr 24, 2020

“Is setting up a limited liability company worth the time and expense?”

“doesn’t it seem shady, will it complicate my efforts to document my vessel with the u.s. coast guard”.

Rest assured, creating a limited liability company to act as an ownership entity for your vessel is a great idea. It is easy to do, and far from being shady, it is actually the more financially prudent and socially responsible choice for any vessel owner. The U.S. Coast Guard will not suddenly suspect you of tax evasion or gun-running if you choose to document your vessel in the name of a limited liability company.

The following article will address the benefits of using a limited liability company to hold a vessel. This article is equally applicable to recreational vessel owners, commercial fishing vessel owners, and charter boat owners.

Many vessel owners are unsure if it is necessary or even helpful to own their vessels through limited liability companies, rather than holding the vessel as a personal asset. The truth is, using a limited liability company as an ownership vehicle for a vessel is the responsible thing to do for anything from a small passenger vessel, to a commercial fishing vessel, to a superyacht. Setting up and maintaining a limited liability company has never been easier, with many states now providing online filing services. The fees associated with establishing and administering a limited liability company have also dropped. For example, in Washington it is possible to set up a limited liability company online for less than $300 in filing fees. Typically, the limited liability company formation documents will be processed and officially recognized by the Washington Secretary of State in less than 48 hours. When considering spending hundreds of thousands, if not millions, of dollars on a new vessel it is always wise to spend the comparatively small amount of time and money necessary to set up a limited liability company. The potential savings are enormous and more importantly, the risks of not having a limited liability company can be financially ruinous.

All vessels, regardless of their use, present an unusual concentration of risk.

Indeed, for many recreational vessel owners, some amount of risk may be part of the attraction. All the same, the prudent owner should take steps to minimize the scope of their risk. By owning a vessel through a limited liability company, the owners can cordon off the risk created by their ownership and use of a vessel and ensure that other assets or aspects of their lives are not implicated should the risk of vessel ownership manifest in an accident, injury, or loss of any kind.

Consider, for example, the owner of a mid-sized personal recreational vessel, which is held personally by the owner. The owner takes some friends out for a day trip, and wanting to entertain his guests, lets one of them briefly pilot the vessel. Of course something unexpected goes wrong, and someone is seriously injured. Though the owner carries insurance, his insurer refuses to provide covered on the basis that the owner, the insured, was not actually operating the vessel at the time of the incident. Because the owner did not hold the vessel through a limited liability company he is now personally liable for all the medical costs incurred by the injured party.

Alternatively, consider an owner who operates a commercial fishing vessel, a limit seiner in Southeast Alaska, and another commercial fishing vessel, a gillnetter, in Bristol Bay. Both vessels are held personally by the owner and not in limited liability companies. Under such an arrangement both vessels are open to seizure by the owner’s creditors. This could result in a nightmare scenario wherein an indebted owner’s vessels are seized by creditors, depriving the owner of the only means they have to pay off the underlying debt. If the owner’s vessels were held by one or more limited liability companies, the owner’s creditors would not have access to the limited liability company’s assets. This would allow the owner to continue using the vessels to ensure any outstanding debt was eventually paid down, rather than filing for bankruptcy.

While owning vessels through a limited liability company does not free the owner from the responsibility to obtain insurance or pay taxes, limited liability company ownership is still a very helpful means of limiting liability. Considering how easy it is to set up a limited liability company, there is no reason not to use one.

As the name suggests, the main benefit of using a limited liability company is that they allow members to limit their liability.

If a vessel is owned by a limited liability company, liability for incidents involving the vessel flow to the company itself, instead of its members. When a vessel held by a limited liability company is involved in an accident that leads to litigation, an injured party would need to sue the limited liability company that holds the vessel. The limited liability company members personal assets are shielded from creditors of the limited liability company and conversely, the limited liability company’s assets (usually the vessel) are shielded from creditors of the owner. If a limited liability company is properly structured, creditors of a member cannot force the sale or seizure of the limited liability company’s assets. Generally, creditors are only able to obtain a charging order from a court which directs the limited liability company to divert its income to the creditors, rather than distributing it to the indebted member. A charging order does not allow creditors to access limited liability company assets directly.

The liability protection provided by a limited liability company is not unlimited or unconditional. The liability shields provided by limited liability companies were designed to protect businesses and not private individuals. Therefore, courts can “pierce the corporate veil” and hold the members of a limited liability company personally liable if they determine that the limited liability company serves no legitimate business purpose. Also, if assets are transferred to a limited liability company after the owner of those assets has a creditor, a court could construe this as a “fraudulent transfer,” intended only to shield assets from creditors. If a court determines that a transfer was fraudulent, and intended only to shield assets from existing creditors, the court can allow creditors to recover those assets.

In order to ensure that a limited liability company provides the maximum amount of liability shielding, limited liability companies must be operated in every respect as a separate entity from the owner. When administering a limited liability company, members must treat it as its own legal entity. This means taking steps to ensure that the limited liability company’s accounts and a member’s personal accounts are not used interchangeably; for example, a member should never use limited liability company funds to pay for personal expenses. Limited liability company funds should not be intermingled with personal funds. If a loan is made to the limited liability company by one of the members, it must be treated as a normal loan, even if the individual is effectively loaning money to themselves in a single member limited liability company. Convincing a court to pierce the corporate veil is very difficult, especially when the limited liability company member or members have been diligent about treating the limited liability company as a separate legal entity. If the members operate and administer a limited liability company correctly, any would-be litigant will face a very heavy evidentiary burden to convince a court that the limited liability company is a sham. This type of litigation is costly and time consuming. This fact alone will deter many would be litigants.

In addition to liability protection, limited liability companies can also offer anonymity.

For example, limited liability companies formed in Delaware are not required to publicly disclose the identity of member’s and managers. Again, this anonymity is not complete. A court or tax authorities can order the limited liability company to reveal its membership under certain circumstances. Despite this, the anonymity protections provided by Delaware limited liability company laws are quite beneficial. As with piercing the corporate veil, the high cost of legal fees and court costs required to obtain a court order revealing the identity of limited liability company members will dissuade many potential litigants.

In conclusion, vessel owners of all kinds should consider the benefits of owning their vessels through a limited liability company. The cost of setting up a limited liability company is small and the administrative obligations for the members are minimal. Anyone planning to purchase or build a vessel should contact a competent business attorney to quickly set up a limited liability company and draft an operating agreement designed for a company meant to hold ownership of vessels. This should be considered as just another part of the purchase process for any vessel. Finally, vessel owners considering using a limited liability company to hold their vessel must be sure that the inform their insurance provider and are sure to transfer insurance coverage to the limited liability company that holds the vessel.

The next article in this series will address the use of Trusts, both in the United States, and in offshore jurisdiction, as an alternative ownership vehicle to limited liabilities companies.

FAQ’s About Yacht As A Business Ownership and Tax Advantages

Many of your questions and doubts will be answered in this list but if not, please feel free to give us a call or email us. Also read the article explaining Yacht Business Ownership in more detail.

| Should I Own The Yacht Personally Or Through A Corporation?

It is better to own the yacht in a corporation because it reduces personal liability. It is a smart thing to do when running the yacht as a business where it will be for charter. If you place the vessel in an LLC the tax benefits flow through to you personally.

| Can I Legitimately Take The Tax Deductions?

If you are actively involved in the business and meet the IRS tests for active participation then it is a business and you can legitimately take the deductions and benefit from it. You need to show active participation as well as the ability and the intent to make a profit.

| What Type Of Active Participation Is Required?

The most common test is that the owner does a minimum of 100 hours and more than any other one person. If you do a website, attend trade shows, do familiarization trips and technical inspection of asset directly related to your business, you will log far more than 100 hours.

| How Do I Meet The Requirements?

In the course of running the business:

- Attend a trade show such as the Annapolis trade show where the yacht is promoted for charter, you would easily and legitimately log 50 to 75 hours.

- Apart from the chartering component of the business where the LLC (sub contractor) generates income through the charter company (general contractor) there are other income streams for the LLC such as charter sales where the LLC earns commission from charters sold on its own yacht, as well as other yachts in the fleet.

- To be effective and facilitate the sale of charters, the owner would need to do “familiarization” trips to have good knowledge of the product being sold which is the cruising ground (this is much like a travel agent who travels to destinations that they promote and sell packages into).

- One familiarization trip per year would log a minimum of 50 to 100 hours. It is also reasonable to have an annual inspection of the asset, which would require traveling to where it is located, again this would log 50 to 75 hours at the very minimum.

| Will Doing This Trigger An IRS Audit?

There is always the chance of an audit when a large deduction is generated, if proper records are kept and the owner does actively participate with the intent to make a profit then the standard is met and should satisfy scrutiny. Your CPA is the best person to answer this question because personal circumstances differ from person to person.

| What Amount Of Money Must I Put Down To Get Into The Program?

The deposit required by most lenders is 20 % so the cash out would be 20% of the full purchase price plus two months of mortgage payments in the Guaranteed program and two months of mortgage payments plus the insurance premium (1.5% of hull value) in the performance program.

| Is The Boat Insured During The Program And How Am I Protected?

The boat has comprehensive insurance in the name of the owner or the LLC from the time the keels touch the water. If there is a loan the lender is recorded as the first loss payee and DYC is noted on the policy for charter operations. The deductible is covered by an additional insurance policy that the charterer pays, so the owner has no exposure to a deductible unless they cause the damage themselves.

| What Tax Reporting Is Required?

Your CPA will be able to answer this but generally the LLC would generate a K1 which would be incorporated into the tax return

| Do The Tax Advantages Flow Through To Me Personally?

Yes they do.

| Is There Recapture On The Tax Advantages When I Sell The Boat?

Yes, there is if you sell the yacht outright at the end of the program and the rate is at ordinary income. If you keep the vessel for personal use after the program than this should not be an issue but check with your CPA for your personal situation. The third alternative is to trade the yacht is and do a “like kind” exchange in which case there is no recapture.

Common Misconceptions About Running a Boat as a Business

| putting a yacht into charter is a passive activity like rental property.

Wrong, if you put the vessel into a Corporation and run it as a business and ensure you meet the relevant standards and tests then it is a small business and is taxed accordingly. Note, that if you go into a guaranteed income program where you sign a long term management agreement and receive a monthly guaranteed income, then this is passive activity and you will not be allowed to generate tax advantages save and except if you have passive losses that you can be offset against passive income.

| You Need 500 or 700 Hours Of Active Participation To Qualify

No, the test most commonly used is ” a minimum of 100 hours and more than any other one person”. You will find that the US staff and base staff, who all have different tasks, will never spend more time on your boat individually than you will in a given year. Remember that the trade shows, familiarization trip, asset inspection trip, marketing, contract negotiation (we renegotiate the contract each year) would result in close to two hundred hours of active participation not to mention that all costs are also deductible.

| You Will Automatically Trigger An Audit

Unlikely that an audit is automatic, this is not the experience we have over the last eight years. The issue is to meet the tests and standards and ensure that you are in compliance with the rules. This is not for everyone but if scrutinized and everything is in order then it is unlikely that it would proceed to an audit.

| You Have To Make A Profit Three Out Of Five Years To Avoid “Hobby Loss” Rules

The rules state that if you make a profit three out of five years then hobby loss cannot be applied. To be clear, you DO NOT HAVE to make a profit three out of five. Many CPAs make this statement, which is not entirely accurate as it is interpreted the wrong way. The actual rule is that you have to have “the Ability and the Intent” to make a profit which is clearly the case here.

| A Yacht Does Not Qualify For Tax Advantages

The yacht is equipment that is being purchased and placed into service in a small business that has the ability to make a profit if well run which is the intent. The same rules would apply to the owner of a dump truck who sub contracts to a general contractor, there is fundamentally no difference. The truck would qualify for section 179 and Bonus Depreciation if purchased new. The owner would be actively involved even if there is an employed driver because of contract negotiations, marketing admin etc. and the intent is also to make a profit.

| You Cannot Use The Yacht While It Is In The Program

You can use the yacht. It is generally agreed between most CPA’s who are familiar with the program that 10% of private use by the owner over and above the familiarization and asset inspection trips, is acceptable.

For More Information About Yacht Business Ownership And Tax Advantages, Contact Us

Estelle Cockcroft

Join our community.

Get the latest on catamaran news, sailing events, buying and selling tips, community happenings, webinars & seminars, and much more!

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

Top 10 Reasons to Sell (and Sail) Your Catamaran in Annapolis, MD

We have a new home in Annapolis! The office is located in Annapolis, Maryland

Top 10 Reasons to Sell (and Sail) Your Catamaran in Texas

Our Texas Office is located in the Watergate Marina Center in Clear Lake Shores,

Annapolis Boat Show 2024

Meet with our team! Want to learn more about the Bali and Catana

Exploring the Catana OC 50 Catamaran: A Comprehensive Overview

The Catana OC 50 Catamaran, the latest addition to the Catana Ocean Class series,

For more than 30 years, we have been a part of the catamaran community and created Catamaran Guru™ to encourage and educate all the aspiring sailing out there. We understand the dream of traveling the world by catamaran and created a one-stop-shop to make that dream a reality for you.

- Stephen & Estelle

- Testimonials

Get Started

- Yacht Sales

- Used Yachts

- Charter Management

- Boat as Business Programs

- Seminars & Events

- Center Consoles

- Dual Consoles

- Motoryachts

- Sport Cruisers

- Tenders & Ribs

- U.S. Atlantic

- Engine Buyers Guide

- Electronics

- Digital Edition

How to Make Your Yacht an LLC

Here’s how to make your yacht an llc and reap the financial benefits—as long as you pay close attention to the requirements., here are some important steps to follow:, establish a business entity to own the yacht, arrange for financing, setup a business plan, in addition, here are some tips to consider:, how to make your yacht an llc, first ever foiling regatta in the caribbean, formula 400 ssc.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Receive our Newsletter

Recommended

Old Bight, Cat Island

What To Look For When You Need A Boat Yard

Don't miss it

Marine Generator Maintenance: Helpful Tips You Need To Prevent Issues

Slow Down Ahead. How Much Will They Cut?

View From the Pilothouse – September 2024

Explore 4 of the Best US Boating Destinations: Michigan, Maine, and More!

End-of-Season Boat Maintenance: Winter Prep is Crucial to Ensure Peace of Mind

The Pursuit OS 405 Review: Reliable Comfort and Performance for Fishing and Cruising

- Terms Of Service

- Privacy Policy

1591 E. Atlantic Blvd, 2nd Floor Pompano Beach, FL 33060 Office: +1 (954) 522-5515 Fax: +1 (954) 522-2260 Contact us: [email protected]

© 2024 Southern Boating Media

Please use a modern browser to view this website. Some elements might not work as expected when using Internet Explorer.

- Landing Page

- Luxury Yacht Vacation Types

- Corporate Yacht Charter

- Tailor Made Vacations

- Luxury Exploration Vacations

- View All 3707

- Motor Yachts

- Sailing Yachts

- Classic Yachts

- Catamaran Yachts

- Filter By Destination

- More Filters

- Latest Reviews

- Charter Special Offers

- Destination Guides

- Inspiration & Features

- Mediterranean Charter Yachts

- France Charter Yachts

- Italy Charter Yachts

- Croatia Charter Yachts

- Greece Charter Yachts

- Turkey Charter Yachts

- Bahamas Charter Yachts

- Caribbean Charter Yachts

- Australia Charter Yachts

- Thailand Charter Yachts

- Dubai Charter Yachts

- Destination News

- New To Fleet

- Charter Fleet Updates

- Special Offers

- Industry News

- Yacht Shows

- Corporate Charter

- Finding a Yacht Broker

- Charter Preferences

- Questions & Answers

- Add my yacht

- Yacht Charter Fleet

Exclusive: New 87m Lurssen superyacht named AVANTAGE

- Share this on Facebook

- Share this on X

- Share via Email

By Katia Damborsky 26 June 2020

Still officially known as Project Hawaii, YachtCharterFleet can exclusively reveal that Lurssen's 87m (285') superyacht is now known as superyacht AVANTAGE .

Launched earlier this year at Lurssen's Rendsburg facilities, AVANTAGE is the newest addition to the Lurssen fleet.

The German shipyard is yet to disclose her name or any official details about the superyacht, but her AIS tracking data shows her name has been updated to AVANTAGE.

She is currently on sea trials in the Baltic Sea, and she is on course for delivery later this year.

Lurssen is notorious for guarding information about their yachts; however from the data recorded during her sea trials, we can see she reached a top speed of almost 17 knots ( Speed Avg/Max 9.7 kn / 16.9 kn).

The 2,950 GT superyacht features exterior and interior styling from long-time Lurssen collaborators Bannenberg & Rowell. She marks the sixth Lurssen yacht to be penned by Bannenberg & Rowell.

The British studio has created a sleek and timeless profile with sweeping lines that add a sporty element. Key features include a jacuzzi on the main deck aft that looks over a spacious swim platform below, and a generous sundeck with glass bulwarks.

Before the yacht's name was revealed, the 'A' emblem on her foredeck was a clue as to her moniker. This space looks like it might function as a helipad.

Construction on luxury yacht AVANTAGE began in 2017. The motor yacht hit the waters of the Kiel Canal for the first time on January 21.

It is not yet known whether the superyacht will be available for luxury yacht charters .

You can view and compare all Lurssen charter yachts .

stand-out lurssen yachts for charter:

73m Lurssen 1994 / 2022

85m Lurssen 2013 / 2022

95m Lurssen 2014

136m Lurssen 2019

RELATED STORIES

Previous Post

Breaking: 2020 Monaco Yacht Show cancelled

Video: 95m Greek superyacht O'PARI completed and ready for 2020 Greece Charters

EDITOR'S PICK

Latest News

18 September 2024

17 September 2024

16 September 2024

- See All News

Yacht Reviews

- See All Reviews

Charter Yacht of the week

Join our newsletter

Useful yacht charter news, latest yachts and expert advice, sent out every fortnight.

Please enter a valid e-mail

Thanks for subscribing

Featured Luxury Yachts for Charter

This is a small selection of the global luxury yacht charter fleet, with 3707 motor yachts, sail yachts, explorer yachts and catamarans to choose from including superyachts and megayachts, the world is your oyster. Why search for your ideal yacht charter vacation anywhere else?

136m | Lurssen

from $3,328,000 p/week ♦︎

115m | Lurssen

from $2,874,000 p/week ♦︎

85m | Golden Yachts

from $1,001,000 p/week ♦︎

88m | Golden Yachts

from $1,222,000 p/week ♦︎

83m | Feadship

from $1,113,000 p/week ♦︎

93m | Feadship

from $1,556,000 p/week ♦︎

Maltese Falcon

88m | Perini Navi

from $490,000 p/week

122m | Lurssen

from $3,000,000 p/week

As Featured In

The YachtCharterFleet Difference

YachtCharterFleet makes it easy to find the yacht charter vacation that is right for you. We combine thousands of yacht listings with local destination information, sample itineraries and experiences to deliver the world's most comprehensive yacht charter website.

San Francisco

- Like us on Facebook

- Follow us on Twitter

- Follow us on Instagram

- Find us on LinkedIn

- Add My Yacht

- Affiliates & Partners

Popular Destinations & Events

- St Tropez Yacht Charter

- Monaco Yacht Charter

- St Barts Yacht Charter

- Greece Yacht Charter

- Mykonos Yacht Charter

- Caribbean Yacht Charter

Featured Charter Yachts

- Maltese Falcon Yacht Charter

- Wheels Yacht Charter

- Victorious Yacht Charter

- Andrea Yacht Charter

- Titania Yacht Charter

- Ahpo Yacht Charter

Receive our latest offers, trends and stories direct to your inbox.

Please enter a valid e-mail.

Thanks for subscribing.

Search for Yachts, Destinations, Events, News... everything related to Luxury Yachts for Charter.

Yachts in your shortlist

SuRi Yacht – The Amazing $45M – Superyacht

The Best Yacht Concepts From Around The World

The Stunning Ritz Carlton EVRIMA Yacht

Gliding Across Tokyo’s Sumida River: The Mesmerizing Zipper Boat

- Zuretti Interior Design

- Zuretti Interior

- Zuccon International Project

- Ziyad al Manaseer

- Zaniz Interiors. Kutayba Alghanim

- Yuriy Kosiuk

- Yuri Milner

- Yersin Yacht

- Superyachts

AVANTAGE Yacht – Divine $200M Superyacht

AVANTAGE yacht is an 87m(285,4 ft) superyacht built by Lürssen Yachts in their German shipyard, and delivered in 2020.

The interior design, executed by Bannenberg & Rowell Design, has accommodation for 14 guests and 19 crew members.

This superyacht, specifically designed for socializing and family enjoyment, boasts a variety of entertainment features. She ranks 119 of yachts worldwide.

| Avantage | |

| 87m (285ft) | |

| 14 in 7 cabins | |

| 18 in 9 cabins | |

| Lurssen | |

| Bannenberg Rowell | |

| 2020 | |

| 16 knots | |

| MTU | |

| 2,950 ton | |

| US $200 million | |

| US $15 – 20 million |

AVANTAGE yacht interior

The interior design is masterminded by Bannenberg & Rowell Design, accommodating 14 guests and a crew of 18.

She was built by Lürssen in their German shipyard. She features five exterior decks, a foredeck helipad, and a sundeck jacuzzi.

The beach club offers an effortless indoor-outdoor entertainment experience that is a stylish addition to the yacht.

The main deck has space for an alfresco lounge and dining area in the sunshine, with a half deck that is shaded by the upper deck overhang.

Her interior design is timeless, with beautiful furnishing and seating that make guests want to sink in and relax.

The yacht interior exudes an elegant yet comfortable atmosphere. This design makes her an ideal yacht for socializing and entertaining with friends and family.

She is also equipped with high-tech audio-visual equipment.

The exterior design of the AVANTAGE yacht is designed by Bannenberg & Rowell Design. She has a white hull of steel, aluminum superstructure, and teak decks. Her exterior exudes a modern, stylish, and sleek appearance.

There are open deck spaces, long and elegant lines, and a large foredeck with the yachts emblem.

She is equipped with a Compass Tenders Limo Tender, amongst other luxury water toys that make her a fun and entertaining yachting experience. She has a yearly running cost of $15-$20 million.

Specifications

The AVANTAGE yacht has a gross tonnage of 2950 GT, which is 473.14 GT above average for her class. She is powered by her two MTU diesel engines.

She is in the top 5% of LOA in the world with a length of 87m(285.4ft), a draft of 4m(13.1ft), and a beam is 13.8m(45.3ft), AVANTAGE has a max speed of 16 knots and a cruising speed of 12 knots.

She has a 4.500 nautical mile range. She is built to Lloyds register 100 A1 classification society rules and is equipped with an Underway and an at anchor stabilization system.

This reduces the rolling motion effect at seas, resulting in a smoother and more enjoyable cruising experience underway.

Do you have anything to add to this listing?

- Bannenberg Rowell

Love Yachts? Join us.

Related posts.

SAILING YACHT A – World’s Biggest Sailing Yacht – $600 Million

IJE Yacht – Sophisticated $200M Superyacht

BELONGERS Yacht -Indulgent $25 M Superyacht

ELEMENTS Yacht – Elevated Experience $125M Superyacht

- Weekly Newsletter

California's Boating & Fishing News

Ask a Maritime Attorney: Should I buy the boat through an LLC?

I am considering the purchase of a boat that is titled in a Delaware LLC. I have completed sea trial and survey and we are preparing to close pursuant to the provisions of the yacht purchase agreement, but the broker suggested that I consider the purchase of the LLC itself. He indicated that this would allow me to avoid payment of California sales or use tax and to continue the liability protections that are available through LLC ownership. Can you offer some guidance as to the significant issues that I should be aware of in this type of transaction?

We are often asked to comment on the pros and cons of ownership of a boat by a corporation or LLC, and I will note at the outset that it’s not for everyone. However, before we get into the pros and cons of owning or buying a boat through a business entity – whether a corporation or LLC – we need to address a logistical issue raised by our reader.

He indicated that the parties are preparing to “close” the deal pursuant to the provisions of the vessel purchase agreement, but that he is now considering the purchase of the LLC that owns the boat. He needs to slow down a bit. If the parties close pursuant to the provisions of the vessel purchase agreement, the LLC won’t own the boat anymore, since the purchase agreement calls for the current owner to sell the boat to the buyer. The buyer would therefore own the boat in his own name rather than in the name of the LLC, and he would be purchasing a company with no assets.

If an LLC purchase is being contemplated, the parties should put the brakes on the vessel purchase – – – if that’s possible. At this late date the buyer is likely obligated to purchase the boat or risk losing his deposit for breach of the purchase agreement. This is therefore an element of a vessel purchase transaction that needs to be considered at the beginning rather than waiting until the last minute.

With these logistical issues in mind let’s take a look at the transaction itself. We should first point out that sales and use tax are essentially the same thing. Use tax is sometimes confused with the annual assessment of property tax, but sales and use tax are both assessed at the time of the purchase of personal property, and they are assessed at the same rate. The only real difference is that sales tax is assessed on the retail purchase of a new asset while use tax is assessed on the purchase of a previously owned asset.

In California, the purchase of a corporation or LLC that owns a boat as its sole asset is not subject to the assessment of sales or use tax (for the purposes of this discussion there is little difference between a corporation and an LLC). This is because sales and use tax are not assessed on the purchase of corporate securities or the purchase of part or all of a business entity.

The purchase of an LLC that owns a boat is exempt from the tax assessment because, when the business entity is sold, there is no change in the title or ownership of the company’s assets. Since the boat is still owned by the LLC, there is no purchase or sale of the boat and nothing to assess sales or use tax against.

This tax exemption works only when the LLC already owns the boat. Business entities are taxpayers like everyone else, and the LLC’s acquisition of an asset such as a boat will be subject to the assessment of sales or use tax unless it qualifies for an exemption.

We should also note that the ownership of a boat by an LLC as the company’s sole asset is unlikely to provide any special protection against legal liability. A “corporate shield” against personal liability may exist for a corporation or LLC that operates a legitimate business, but here we are talking about a company with no business purpose whose sole asset is a recreational vessel. In the event of a lawsuit against the owner of the vessel, a plaintiff’s attorney may be able to “pierce the corporate veil” and pursue the shareholders personally, as if the business entity did not exist.

Another logistical issue concerns the broker’s involvement in the transaction. In California, a broker who represents parties in the purchase and sale of a company or business opportunity must be licensed by the Department of Real Estate. A California Yacht and Ship Broker’s license is required for the sale of a yacht, but as noted above the yacht in these transactions is not actually being sold.

So, with all of this in mind, we can see that ownership of a boat by a corporation or LLC is not for everyone. As noted above it may provide a buyer with a tax exemption, and depending on your personal circumstances it may offer other benefits, but buyers and sellers should discuss the structure with their legal or tax advisors before proceeding.

David Weil is licensed to practice law in the state of California and as such, some of the information provided in this column may not be applicable in a jurisdiction outside of California. Please note also that no two legal situations are alike, and it is impossible to provide accurate legal advice without knowing all the facts of a particular situation. Therefore, the information provided in this column should not be regarded as individual legal advice, and readers should not act upon this information without seeking the opinion of an attorney in their home state.

David Weil is the managing attorney at Weil & Associates (www.weilmaritime.com) in Seal Beach. He is certified as a Specialist in Admiralty and Maritime Law by the State Bar of California Board of Legal Specialization and a “Proctor in Admiralty” Member of the Maritime Law Association of the United States, an adjunct professor of Admiralty Law, and former legal counsel to the California Yacht Brokers Association. If you have a maritime law question for Weil, he can be contacted at 562-799-5508, through his website at www.weilmaritime.com, or via email at [email protected].

Share This:

- ← Ask a Maritime Attorney: Is There an Argument for Fraud, and Should I be Worried About Breaking a Contract?

- Ask a Maritime Attorney: What do I need to know about starting a chartering business? →

3 thoughts on “ Ask a Maritime Attorney: Should I buy the boat through an LLC? ”

UFI approval for Moscow Boat Show

- Inspiration

Related News

Popular news this week, popular news this month, latest news.

- Yacht Charter & Superyacht News >

Written by Zuzana Bednarova

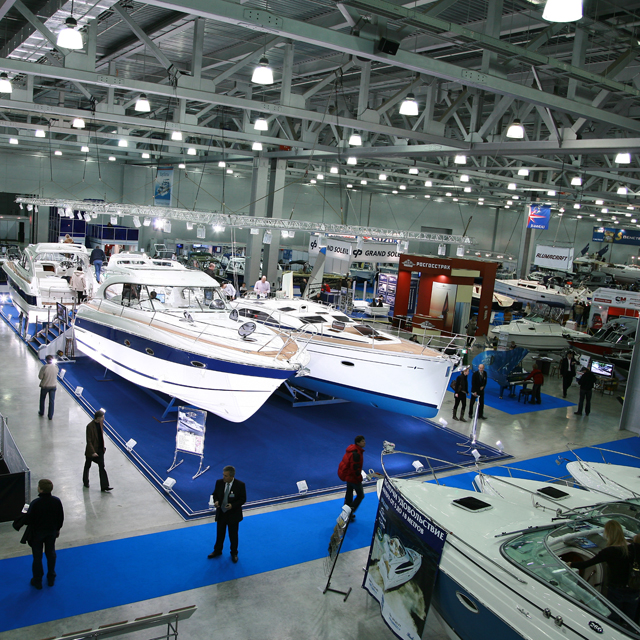

September 17 was marked by meeting of the UFI Executive Committee. During the event, the Committe approved the admission of Crocus Expo IEC as a full member of UFI in categories of “Exhibition Organizers” and “Exhibition Centres. Moscow Boat Show has been granted the status of “UFI Approved Event”.

Moscow Boat Show

UFI, The Global Association of the Exhibition Industry is the association of trade show organizers, fairground owners, national and international associations of the exhibition industry, and its partners. As of 2012, it has 608 members in 224 cities from 86 countries covering 6 continents. The association members are responsible for the management and operation of over 4 500 profile events. The association represents more than 1 000 000 of exhibitors and more than 150 000 000 visitors.

The Crocus Expo Exhibition Centre is a listed member of the International Association of Congress Centres (AIPC), the Russian Union of Exhibitions and Fairs, the Guild of Exhibition and Fair Operators by the Moscow Chamber of Commerce and Industry. Donald Tramp fund has awarded Crocus Expo IEC Diamond Excellence Award.

Crocus Expo IEC is an ideal venue for running of large international and national exhibitions of different profile including congress events, conferences and scientific symposiums.About 50% of all exhibition events of Moscow take place in Crocus Expo and average exposition space load comprises 85%.

Moscow Boat Show provides the perfect platform from which to preview new products, evaluate market trends, and establish long-lasting and commercially profitable partnerships. Despite the dynamic changes taking place in Russia and the rapid growth of the yachting sector, the show continues to complement and reflect the industry’s demand and is a promotional opportunity not to be missed!

The exposition space will increase up to 45 000 sq m in 2013. More than 350 Russian and foreign companies will participate in the show. The scale of the project confirms confident positions of its positive development.

Moscow Boat Show is the largest project in Russia presenting all the best in the world of yachting. The exhibition annually shows high level of attendance and has already proved as significant and noteworthy event in the world of yachts and boats.

Please contact CharterWorld - the luxury yacht charter specialist - for more on superyacht news item "UFI approval for Moscow Boat Show".

- Charity & Fund Raising

- CharterWorld News

- Classic Yachts

- Coronavirus

- Cruise Ship

- Ecological Yachts

- Expedition Yachts

- Expert Broker Advice

- Feature Superyachts

- Interior Design

- Legal & VAT Yacht Issues

- Luxury Catamarans

- Luxury Gulet

- Luxury Phinisi

- Luxury Trimarans

- Luxury Yacht Design

- Luxury Yachts

- Marinas & Harbours

- Marine Ecology

- Marine Electronics

- Marine Equipment

- Mega Yachts

- Modern Yachts

- Motor Yachts

- New Launch Yachts

- New To Charter

- Open Style Sports Yachts

- Private Jets

- Sailing Yachts

- Social Media

- Sports Yachts

- Superyacht Crew

- Superyacht Photographers

- Superyacht Products & Supplies

- Superyacht Refits

- Superyacht Reviews

- Superyachts

- Uncategorized

- Yacht Builders

- Yacht Charter

- Yacht Charter Destinations

- Yacht Charter Picks

- Yacht Charter Specials

- Yacht Delivered to Owner

- Yacht Designers

- Yacht Events & Boat Shows

- Yacht Fashion

- Yacht Industry News

- Yacht Photos

- Yacht Racing

- Yacht Racing & Regattas

- Yacht Safety Equipment

- Yacht Support Vessels

- Yacht Tenders

- Yacht Videos

- Yachting Associations

- Yachting Awards

- Yachting Business

- Yachts For Charter

- Yachts For Sale

Quick Enquiry

Superyacht news:.

Email Your Yachting News to: news @ charterworld.com

Luxury Yachts At Events

The Caribbean

The Mediterranean

Ferretti Group announces its presence at Moscow Boat Show 2013

Dates for the 6th International exhibition of boats and yachts Moscow Boat Show 2013 revealed

VIP Mega-Yacht Destination Flisvos Marina to participate in Moscow Boat Show 2013

Official Opening of Moscow Boat Show 2013 on March 12

OCEA delivers 33m motor yacht ARAOK II to her new owner

39m sailing yacht LINNEA AURORA launched by SES Yachts

MYBA Charter Show 2025 venue announcement

44m charter yacht JEMS offers 9 days for the price of 7 in August in Italy

Contemporary motor sailing yacht REPOSADO has been delivered and is now available for charter throughout Croatia

53m motor yacht MAIA launched by Radez in Croatia

A dream yacht charter in the Mediterranean awaits on 65m luxury superyacht ZAZOU

Luxury mega yacht ROCINANTE seen on sea trials after refit at Lurssen shipyard

76m superyacht CORAL OCEAN offering charter special in the West Mediterranean

The Monaco Yacht Show 2024: a dazzling display of the best superyachts in the world and much more …

66m Benetti motor yacht IRYNA hits water in Italy

IMAGES

COMMENTS

Free and open company data on Florida (US) company YACHT ADVANTAGE, LLC (company number L00000007570) Changes to our website — to find out why access to some data now requires a login, click here The Open Database Of The Corporate World

YACHT ADVANTAGE, LLC is an Active company incorporated on June 27, 2000 with the registered number L00000007570. This Florida Limited Liability company is located at 401 E LAS OLAS BLVD, SUITE 1720, FORT LAUDERDALE, FL, 33301 and has been running for twenty-four years.

Yacht Advantage, LLC Overview. Yacht Advantage, LLC filed as a Florida Limited Liability in the State of Florida on Tuesday, June 27, 2000 and is approximately twenty-four years old, according to public records filed with Florida Department of State.

The Avantage Yacht, a breathtakingly luxurious creation, was brought to life by the world-renowned shipbuilding company, Lurssen Yachts, in 2020.A stunning blend of modern aesthetics and superior engineering, the Avantage is a testament to Lurssen Yachts' craftsmanship and Bannenberg & Rowell's outstanding design capabilities.. Key Takeaways. The Avantage Yacht, built in 2020 by Lurssen ...

Entity Name: YACHT ADVANTAGE, LLC DOCUMENT# L00000007570 FEI Number: 65-1019281 Certificate of Status Desired: Name and Address of Current Registered Agent: CRUCILLA, MARIE S ... Name AIR, LAND AND SEA, LLC Address 401 E LAS OLAS BLVD, SUITE 1720 City-State-Zip: FORT LAUDERDALE FL 33301.

In the world of boat sharing, there is little difference between an LLC and a corporation. Both an LLC and a corporation provide personal liability protection, which is ostensibly the main goal of putting your boat into a corporate environment. Both LLC's and Subchapter S Corporations provide pass-through taxation - meaning you would report ...

Bulat Utemuratov, a Kazakh billionaire entrepreneur, exemplifies the power of entrepreneurship, vision, and hard work. Born in 1957, Bulat is a celebrated personality in Kazakhstan and beyond. Married to Azhar and a father to three, Bulat's influential touch extends far beyond his successful family life. From establishing the renowned ATF ...

The following article will address the benefits of using a limited liability company to hold a vessel. This article is equally applicable to recreational vessel owners, commercial fishing vessel owners, and charter boat owners. Many vessel owners are unsure if it is necessary or even helpful to own their vessels through limited liability ...

The motor yacht AVANTAGE ( formerly known as Project HAWAII ) spotted on 12 July 2020 on her delivery cruise from Germany to Gibraltar. The 87-metre superyac...

YACHT ADVANTAGE, LLC Y. YACHT ADVANTAGE, LLC CLAIM THIS BUSINESS. 350 E LAS OLAS BLVD # 1400 FORT LAUDERDALE, FL 33301 Get Directions. Business Info. Founded --Incorporated ; Annual Revenue --Employee Count 1; Industries Nonclassifiable Establishments; Contacts JOHN F ...

It is better to own the yacht in a corporation because it reduces personal liability. It is a smart thing to do when running the yacht as a business where it will be for charter. If you place the vessel in an LLC the tax benefits flow through to you personally.

Setup a business plan. Identify and estimate the total ownership costs and set up your company to function as a yacht charter business. Determine how much it will cost to dock your yacht versus operating at sea. Estimate all costs including fuel, captain and crew, maintenance, insurance, and other fees depending on the type and use of the vessel.

BEAM. 13.8 m. AVANTAGE is a 87.0 m Motor Yacht, built in Germany by Lurssen and delivered in 2020. Her power comes from two MTU diesel engines. She has a gross tonnage of 2950.0 GT and a 13.8 m beam. She was designed by Bannenberg & Rowell, who also designed the interior. Bannenberg & Rowell has designed 4 yachts and designed the interior of 37 ...

Still officially known as Project Hawaii, YachtCharterFleet can exclusively reveal that Lurssen's 87m (285') superyacht is now known as superyacht AVANTAGE. Launched earlier this year at Lurssen's Rendsburg facilities, AVANTAGE is the newest addition to the Lurssen fleet. The German shipyard is yet to disclose her name or any official details ...

AVANTAGE Yacht - The Impressive $200,000,000 Superyacht. Watch on. AVANTAGE yacht is an 87m (285,4 ft) superyacht built by Lürssen Yachts in their German shipyard, and delivered in 2020. The interior design, executed by Bannenberg & Rowell Design, has accommodation for 14 guests and 19 crew members. This superyacht, specifically designed for ...

A California Yacht and Ship Broker's license is required for the sale of a yacht, but as noted above the yacht in these transactions is not actually being sold. So, with all of this in mind, we can see that ownership of a boat by a corporation or LLC is not for everyone. As noted above it may provide a buyer with a tax exemption, and ...

Yacht Charter & Superyacht News > UFI approval for Moscow Boat Show. UFI approval for Moscow Boat Show. December 06, 2012. Written by Zuzana Bednarova. September 17 was marked by meeting of the UFI Executive Committee. During the event, the Committe approved the admission of Crocus Expo IEC as a full member of UFI in categories of "Exhibition ...

Restaurant-Yacht Chaika: Delicious food in a beautiful setting - See 182 traveler reviews, 118 candid photos, and great deals for Moscow, Russia, at Tripadvisor. Moscow. Moscow Tourism Moscow Hotels Moscow Bed and Breakfast Moscow Vacation Rentals Flights to Moscow Restaurant-Yacht Chaika;

Restaurant-Yacht Chaika: Great. Expansive - See 182 traveler reviews, 118 candid photos, and great deals for Moscow, Russia, at Tripadvisor.

Pet Policy. Maximum of 3 pets per apartment. Dogs and Cats only. There is a one-time pet fee of $325 per pet due at move-in and monthly pet rent in the amount of $25 per pet. Some breed restrictions apply. Please refer to Northland's Restricted Breed List.